2025 holiday retail trends for media buyers

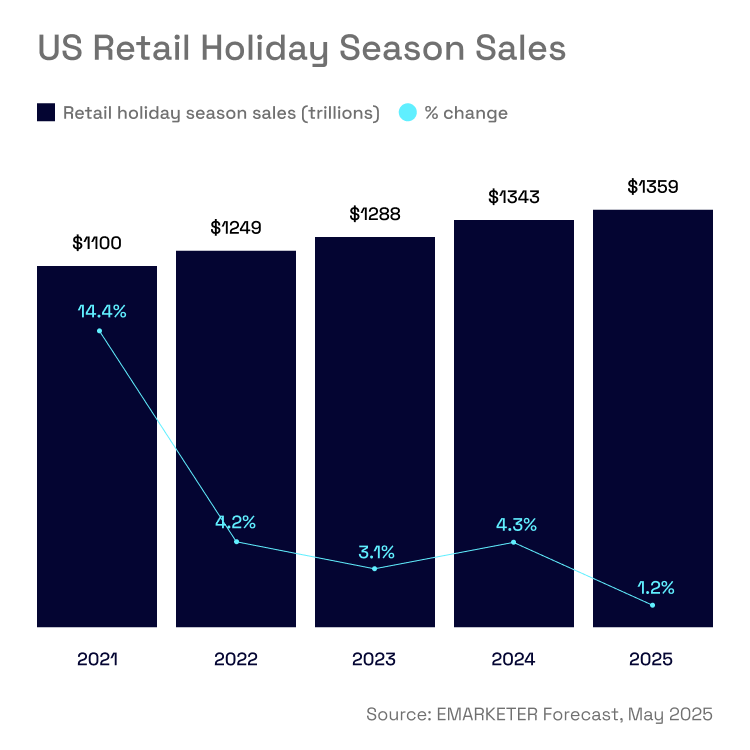

Consumers’ year-end indulgences and the gift-giving spirit have long been a bright spot for retailers and advertisers. But the 2025 holiday season is shaping up to be more about smart shopping than splurge shopping. Emarketer’s latest forecast shows US holiday growth will be 1.2% for November-December — the slowest pace since 2009, representing a $36 billion shift from earlier projections.

That’s actually good news for savvy media buyers. When consumers become more selective about spending, they become more receptive to the right message at the right moment. ‘Tis the season for programmatic buyers to tailor their strategies to meet more intentional, deal-seeking consumers.

Economic uncertainty reshapes consumer behavior

This revised forecast shows a rare departure from typical end-of-year sales acceleration. Depending on potential tariff scenarios, Emarketer estimates a contraction of 2.5-3.7%. According to PwC, we can expect to see a 5% decrease in consumers’ average holiday spend.

Consumer priorities are shifting significantly:

- 47% of holiday gift buyers will buy fewer gifts or spend less due to economic concerns

- 82% may cut back on groceries/essentials to fund holiday purchases

- 27% plan to spend most with smaller businesses (up from 19% in 2024)

But it’s not all doom and gloom! As PwC put it, “spending slows, but celebration stays.” This environment favors advertisers who can demonstrate clear ROI and immediate conversion impact through value-focused messaging.

Holiday shopping timeline accelerates dramatically

The most significant shift is accelerated shopping patterns. Emarketer data shows 21% of US holiday shoppers started by May 2025 — up from 16% in 2024. This early-bird trend fundamentally changes campaign activation timing.

October events now drive holiday momentum:

- Amazon’s October Prime events: projected $9 billion sales (8.8% growth)

- Outpace overall holiday ecommerce growth of 4.2%

- Traditional Cyber Five period declining to 16.3% of holiday ecommerce (down from 20% peak)

There’s another consideration in 2025: Thanksgiving, Black Friday, and Cyber Monday are hitting late this year (November 27-December 1), and 39% of total planned holiday gift spending will happen in these five days. Notably, PwC expects that 80% of consumers’ holiday gift budgets will have been spent by the end of Cyber Monday.

Take action: Target early shoppers with clothing, toys, video games, beauty, and personal care before inventory costs rise and competition intensifies.

Mobile dominates growth and cross-device behavior

Mobile commerce will account for 92.2% of holiday ecommerce growth — $10.31 billion of the $11.18 billion total increase in the US. Mobile is set to capture 56.5% of online holiday sales, significantly above its 46.1% full-year penetration.

But conversions on mobile might not start on mobile: one in three CTV viewers say they get holiday gift inspiration from TV ads. The cross-device reality sets the stage for many potentially critical advertising moments:

- 50% shop for gifts on mobile vs. 31% on computers

- 93% of CTV viewers shop on other devices while watching TV

- 19% always shop while watching (up 17% year-over-year)

- 75% of click-and-collect users make additional purchases when picking up orders

This simultaneous consumption means CTV ads can drive immediate mobile commerce during viewing experiences, making cross-screen coordination essential for capturing conversion moments.

Creative strategy for economic headwinds

Current economic conditions demand specific creative approaches that acknowledge consumer financial concerns while driving conversion.

Value messaging becomes central. With consumers cutting essentials to fund holidays, creative must emphasize smart buying decisions, deals, and affordability over pure aspiration. Supporting research shows 89% of CTV viewers expect holiday TV ads to include specific deals or promotions.

Mobile optimization is mandatory. Ensure all creative assets are designed for mobile consumption with quick load times, given mobile’s dominance of incremental growth.

Personalization improves efficiency. In tighter budget environments, personalized creative leveraging first-party data can improve conversion rates and justify premium inventory investments.

Inventory allocation and budget strategy

The compressed shopping timeline and mobile dominance create specific inventory considerations:

FAST platforms offer cost-effective scale. Free ad-supported streaming (aka FAST channels) provides efficient reach for budget-conscious consumers who over-index for promotional messaging and demonstrate strong brand favorability toward FAST advertisers.

Premium CTV faces pricing pressure. Holiday content viewing spikes will increase demand for premium inventory — budget accordingly and consider FAST alternatives for reach extension.

Sequential messaging strategy. Develop creative sequences that evolve from awareness (early season) to promotion (peak season) to urgency (late season) across the shopping calendar.

Simplify your media buys. Select pre-packaged, curated inventory tailored for seasonal moments and high-value audiences.

Execute early, focus on mobile, emphasize value

The 2025 holiday season rewards advertisers who recognize that economic uncertainty creates opportunity for the right strategies. Launch campaigns early to capture higher-value early shoppers, prioritize mobile-optimized inventory to access the majority of incremental growth, and focus on categories where growth continues despite economic headwinds.

Most importantly, deliver value-focused messaging that acknowledges consumer financial realities while providing clear paths to conversion. The winners will be those who adapt their approach to meet consumers where they are: budget-conscious but responsive to the right proposition delivered through the right channels at the right time.