Performance+ Marketplace formerly PubNative

Put the performance back in performance marketing

Acquire mobile users with engaging ad experiences in a marketplace built for low-funnel conversions.

Reignite audience relationships with technology built on trust, transparency, and privacy

Secret identities are no match for ATOM’s proprietary audience cohort technology, just one of the proprietary features to help marketers reach high value users. The Verve Performance+ Marketplace is built with sophisticated machine learning, diverse chart-topping apps and evolving video formats made for conversion.

What the Verve Performance+ Marketplace delivers

Fine tuned for lower-funnel conversions for brands, agencies, and DSPs.

Global reach across verticals

Tap into a vast network of chart-topping apps across key markets, including gaming, utility, finance, lifestyle, and more. The quality, scale, and diversity of inventory gives you fast, seamless access to over 1.5 billion users worldwide, driving better returns for your campaigns.

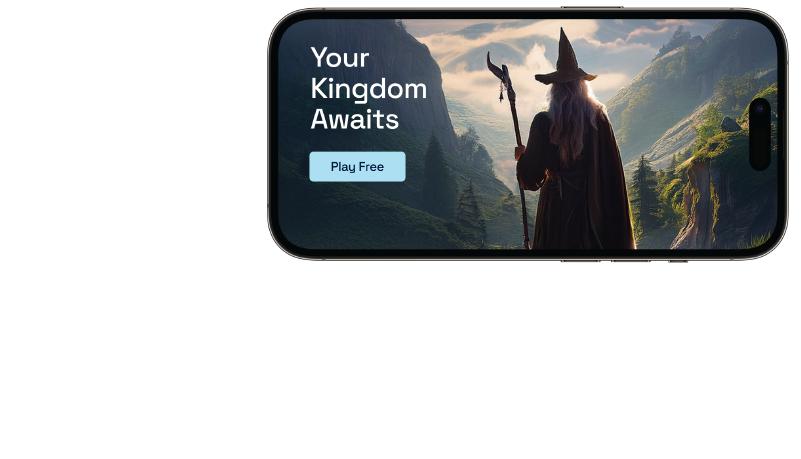

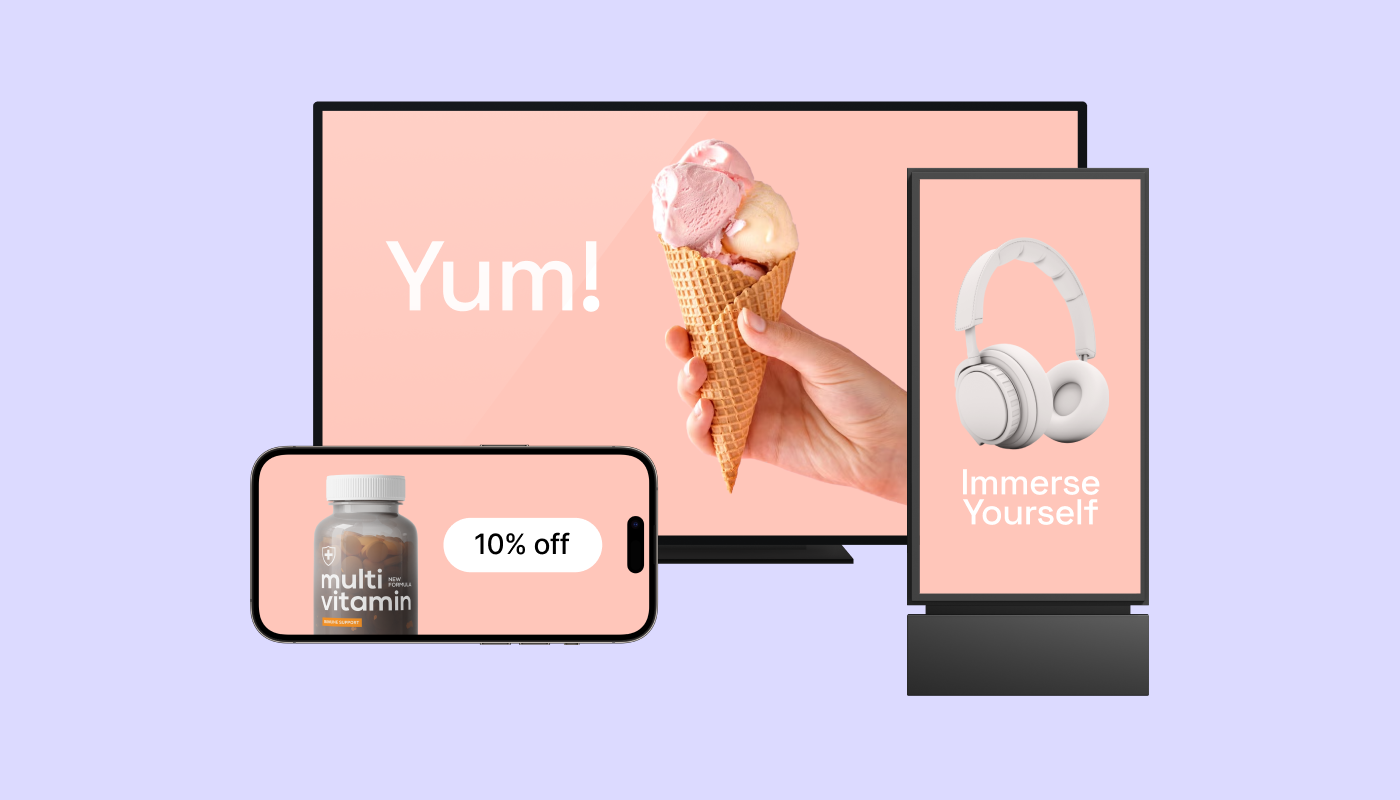

Video ad formats that convert

Gain access to a full suite of high-impact ad formats that are built to deliver on performance marketing goals. Interstitial, rewarded, playable, banners, and native video formats are custom-built to drive conversions while blending seamlessly into the in-app experience.

Complete ID-less addressability

Identifying and acquiring users at scale in an ID-less environment is possible. We deliver 100% addressability using AI-based cohort targeted technology that is future-proofed and compliant to even the strictest privacy requirements.

Your performance toolbelt

A full range of solutions for performance marketers that combines premium inventory with advanced targeting capabilities.

Improve bidding efficiency and reduce acquisition cost with bidstream enrichment, traffic shaping, dynamic pricing and more.

Provides transparency and customization for publishers, supporting a wide array of ad formats and data practices.

From set up, optimization, and reporting tap into services to advise on best practices.

Enhance security with fraud prevention, viewability, and attribution functionalities that comply with the largest names in advertising safety.

01

Open Exchange

Plug in with standard and custom openRTB to maximize campaign reach on Connected TV and mobile inventory, globally.

02

Auction packages

Select pre-built packages that combine targeted inventory and tailored audiences, curated to meet specific KPIs with reliable performance.

03

Custom deals

Connect with us to create custom targeting strategies as unique as your audience. Unlock more tools and options for better results.

Technical features

Global data centers

Latency-free ad delivery and scalability across NAM, APAC and EU.

IAB OpenRTB compliant

Standardized ad delivery and transparency.

Regulatory Compliance

Compliant with CCPA, GDPR, COPPA and more.

Supports Sellers.json and App-ads.txt

Contextual and cohort categorization

Supports ID-less addressability that are in line with IAB definitions.

Independent measurement partners

Viewability supported by IAB OMSDK, fraud prevention by Human and Pixalate, and attribution with integration with MMPs and Apple’s SKAN/AppAttribution API.

Member of Prebid and IAB Tech Lab

Katie Mcbrien

Systems Engineer

“Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed euismod ac urna ac aliquam. Mauris eu tortor non erat facilisis vulputate. Sed laoreet sed sem lacinia finibus”.

Katie Mcbrien

Systems Engineer

“Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed euismod ac urna ac aliquam. Mauris eu tortor non erat facilisis vulputate. Sed laoreet sed sem lacinia finibus”.

Traffic quality and measurement partners

Get more out of your ad spend

Discover how Verve Performance Marketplace can optimize your user acquisition strategies when you integrate with

PubNative HyBid SDK.

Related Content

Press

Blog

Blog

Press

Press

Press

Press

Blog

Blog

Press

Subscribe to stay in the know