Demand Side Platform

Optimizing ad spend is easier than ever

Reduce waste with precision targeting across emerging channels to drive enhanced results in an easy-to-use ad buying platform.

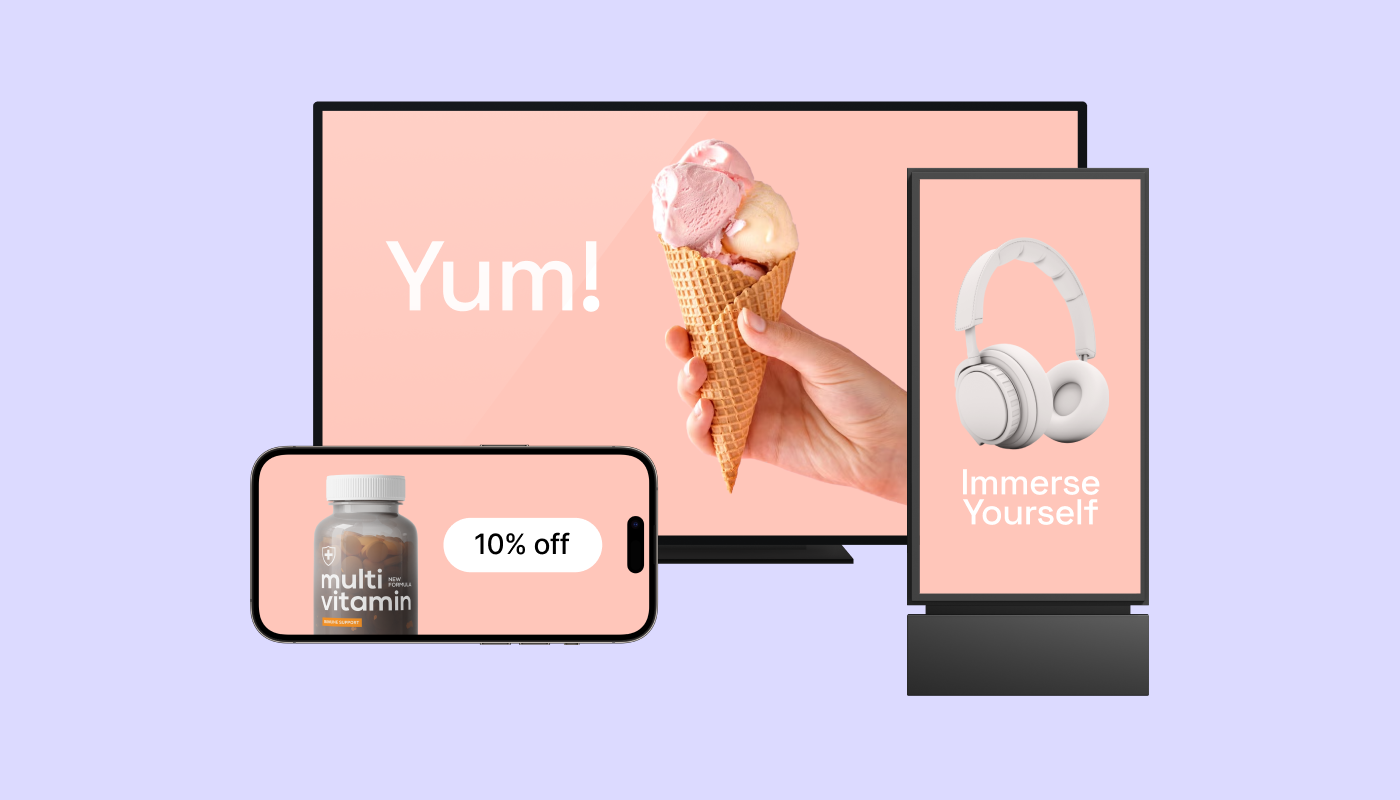

Launch efficient campaigns across mobile, connected TV, digital out of home, and web

Access premium, brand-safe ad inventory in a user-centered tool, right at your fingertips. The Verve Demand Side Platform is a single solution for ad buying, customized to meet your goals with cross-screen media planning and supercharged with 1st and 3rd party data. Our dedicated delivery teams are the cherry on top, acting as your trusted partner to help you exceed your KPIs.

Stronger performance today, built for tomorrow

Advanced targeting and real-time data capabilities deliver real results for every campaign.

Target users in context

Analyze content in real time with proprietary contextual targeting. Deliver highly relevant and timely ads that align precisely with your audience’s immediate interests and needs, even in an ID-less world.

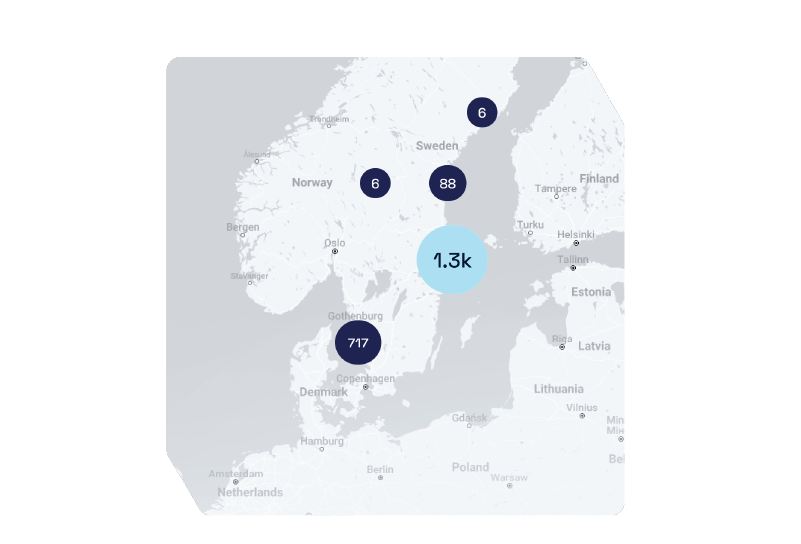

Scale globally across all screen types

Maximize your coverage and impact by reaching more diverse audiences seamlessly across mobile, CTV, DOOH, and web. Gain access to brand-safe inventory on all mediums.

Hit your KPIs with smart algorithms

Reduce waste and boost effectiveness of your campaigns with better ad placements and cost-effective strategies. The end result is better-targeted, more efficient campaigns that boost your overall KPI performance.

Collaborate with the experts

Improve your ad performance by leveraging the local expertise of our dedicated delivery teams, spanning account managers, strategists, and product experts. You’ll also get access to a best-in-class creative services team to transform your standard images into interactive, multi-format creatives.

Diverse advertising applications

Use the Verve Demand Side Platform for a wide range of advertising scenarios, ensuring optimal results across different channels, formats, and tactics.

Channels: CTV, DOOH, mobile, web

Formats: Video, HTML5, full-screen, audio

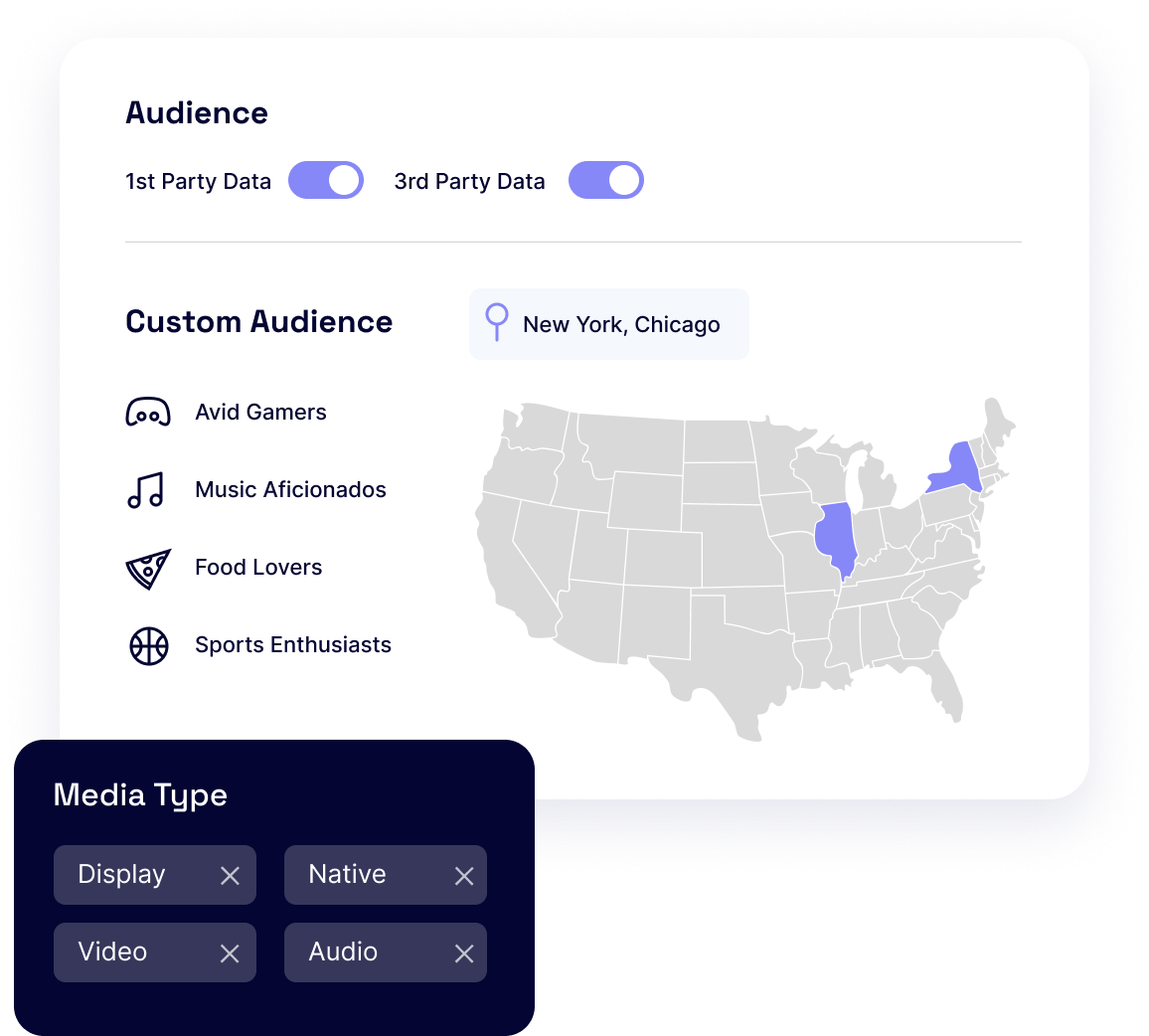

Targeting strategies: zero-, 1st-, 2nd-, and 3rd-party data, custom audiences, and geo-targeting.

Metrics: CPM

KPI: Brand Lift Surveys

Channels: OLV in/out stream, DOOH, web, mobile

Formats: Video, HTML5, display, audio

Targeting strategies: Hyperlocal, Verve Data, 3rd party data

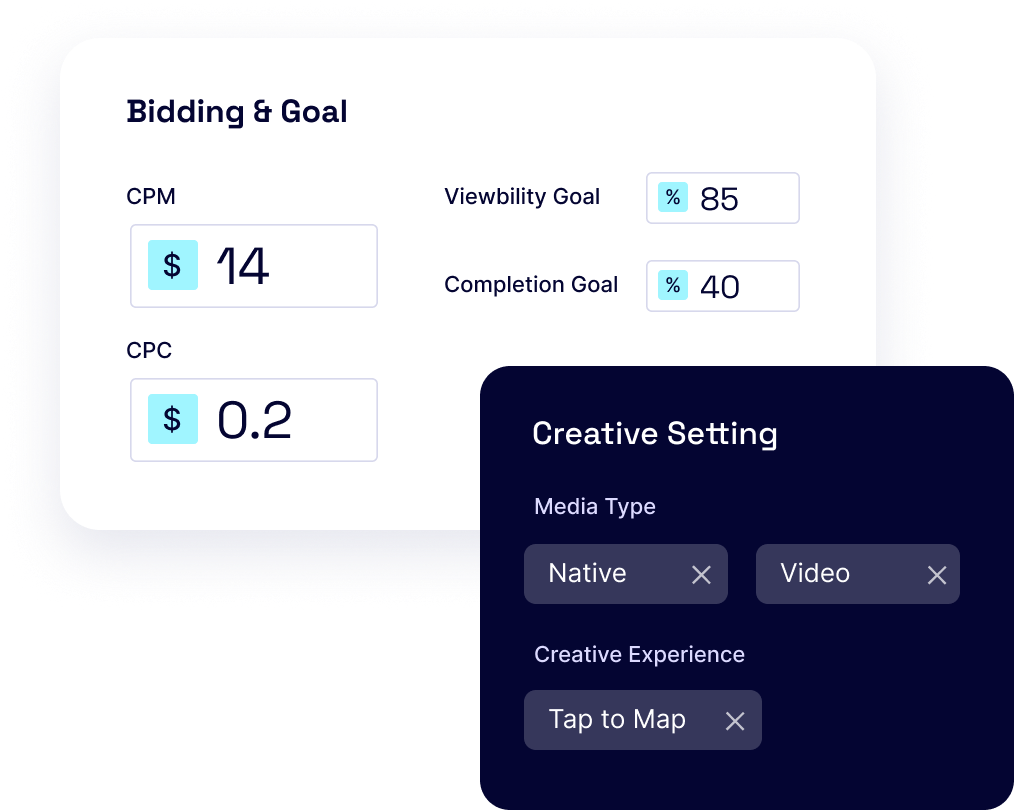

Metrics: CPM, CPC

KPI: Reach, Brand Lift Surveys

Channels: Web, mobile

Formats: Display, banner

Targeting strategies: 1st-party, cookieless cohort

Metrics: CPA

KPI: ROAS

One-stop shop for end-to-end advertising

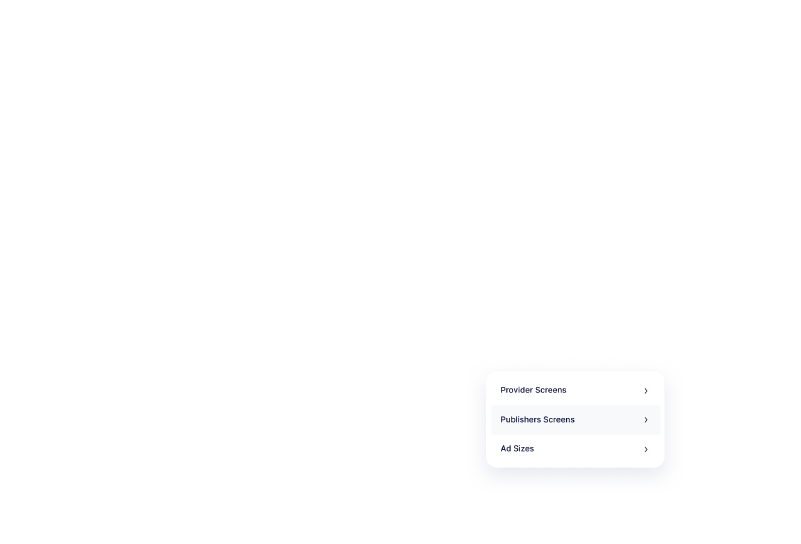

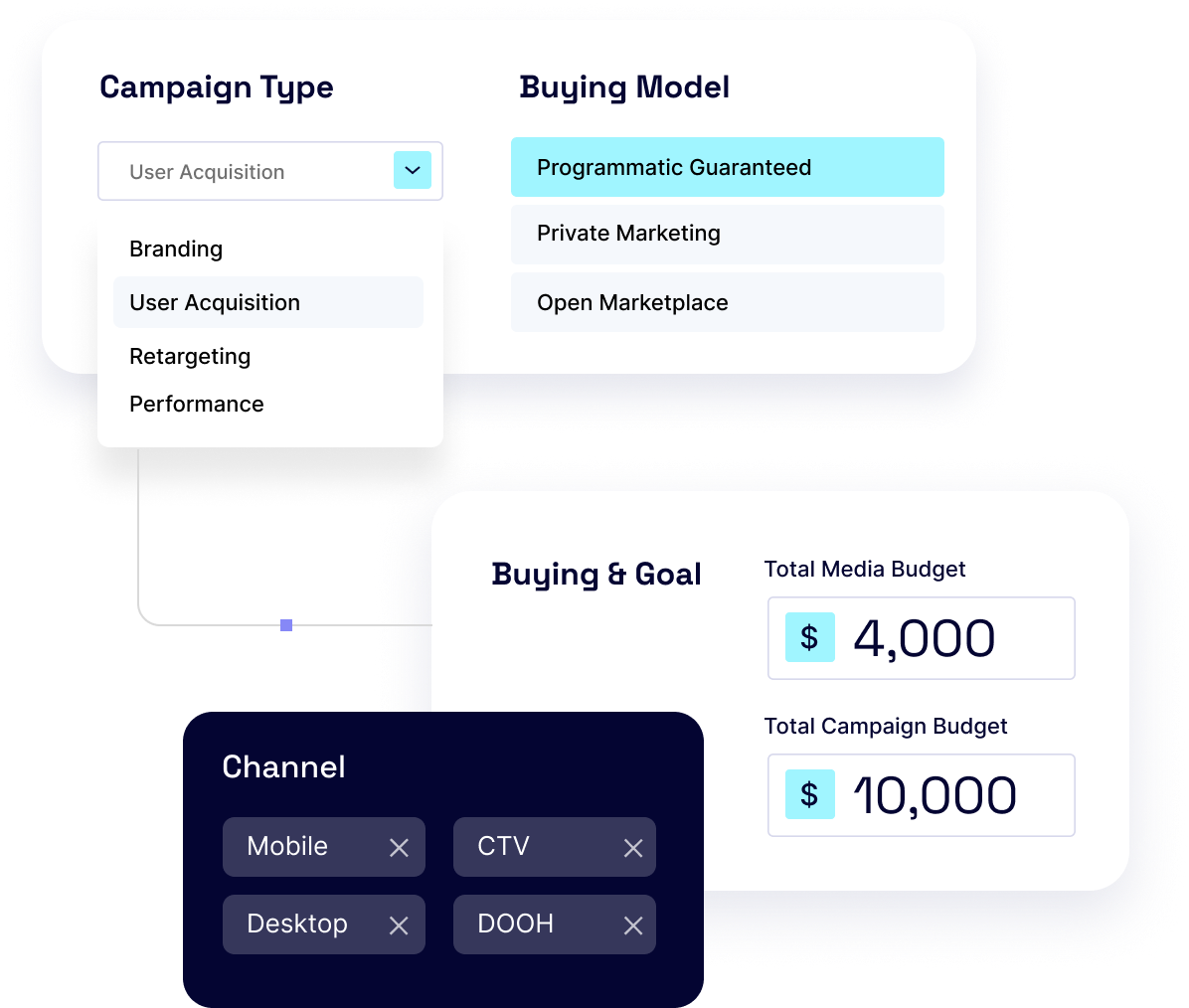

The buying marketplace is equipped with features to add efficiency to every step of the advertising process:

Planning

Access a single platform to map out your ad spend across all devices and channels. Our user-friendly, on-screen tools provide precise estimates to accurately map out the most lucrative campaigns possible.

Activation

Activate your first-party CRM data and people-based graphs from identity partners, or use our proprietary audiences to scale across channels and on any media format of your choice.

Optimization

Access high-quality media sourced through direct publisher relationships on our omnichannel marketplaces. Automate inventory management and execute your guaranteed or non-guaranteed cross-channel spends with confidence.

Brands and agencies that trust us

Carbonatix Ltd

“Our collaboration with Verve has significantly boosted our RTB business and programmatic activities. The combination of high-quality and abundant supply, along with the professional and attentive support from our account manager, has been invaluable for our company's growth. Describing Verve in three words, I would say they are professional, responsive, and revenue-oriented. Year after year, Verve’s team has creatively and effectively elevated our partnership to new heights."

Start simplifying your ad spend

Discover how the Verve Demand Side Platform can streamline your advertising strategy and deliver superior support.

Related Content

Press

Press

Press

Press

Press

Blog

Blog

Press

Case Studies

Press

Subscribe to stay in the know