Ad format FAQ: What’s most effective for mobile, CTV, and DOOH?

Not all ad formats are created equal — and choosing the right one can make or break campaign performance. Let’s tackle the most common questions about which formats work best, and why. Stafaniya Radzivonik, our Senior Director of Supply Partnerships, breaks it down.

Ad performance and revenue

There are so many different ad formats, but which ones perform best in each channel?

Gaming apps

Let’s start with mobile apps, which we can break down by gaming and non-gaming categories.

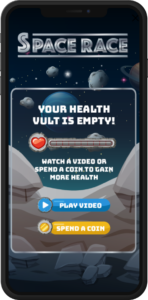

For gaming apps, rewarded video consistently delivers some of the highest eCPMs across the board. Why? It’s user-initiated, non-intrusive, and offers real value. High engagement and completion rates make it a top performer.

Interstitial video ads follow closely. These full-screen formats offer premium visibility and are especially effective when strategically placed at natural breaks in the app experience (like between game levels).

Playable ads also drive strong results for gaming apps. They offer users a hands-on preview of an app or game and tend to convert well, which advertisers are willing to pay more for.

When using these formats, it’s important to manage frequency capping and understand audience behavior. For example, users in Tier 1 countries are typically more discerning about ad quality and frequency.

Game type also matters: casual, hypercasual, hard-core, and mid-core gamers all behave differently. In casual and hypercasual games, display ads like sidebar banners or bottom sticky banners still perform well. Many publishers are testing lower refresh rates to generate incremental revenue and maintain engagement. Since these ads are less intrusive, frequency capping is less critical.

Even hard-core and mid-core gaming publishers, who’ve traditionally worked only with performance-based ad networks, have started adding branded ad networks to their waterfalls. When they use display ads, it’s often through static or dynamic in-game ads. Although technically display, these placements reflect a broader trend: publishers are reevaluating display and adding more inventory to boost revenue.

Non-gaming apps

The analytics for non-gaming apps show that native ad formats (both display or rich media) dominate. They are less disruptive and still highly engaging. There’s also a fluid relationship between display and native. Depending on the highest bid during an auction, display creatives can render in native ad spaces and vice versa. This dynamic conversion helps achieve the highest eCPMs and best fill rates.

Web

On the open web, instream video is in high demand — especially since the IAB’s updated video ad guidelines phased out outstream video. This format drives competitive eCPMs and fill rates.

In-banner video has also reappeared on the radar of web publishers seeking to maximize their monetization opportunities. Multi-ad format support, alongside strong UI integration, helps to make audiences more addressable and inventory more monetizable.

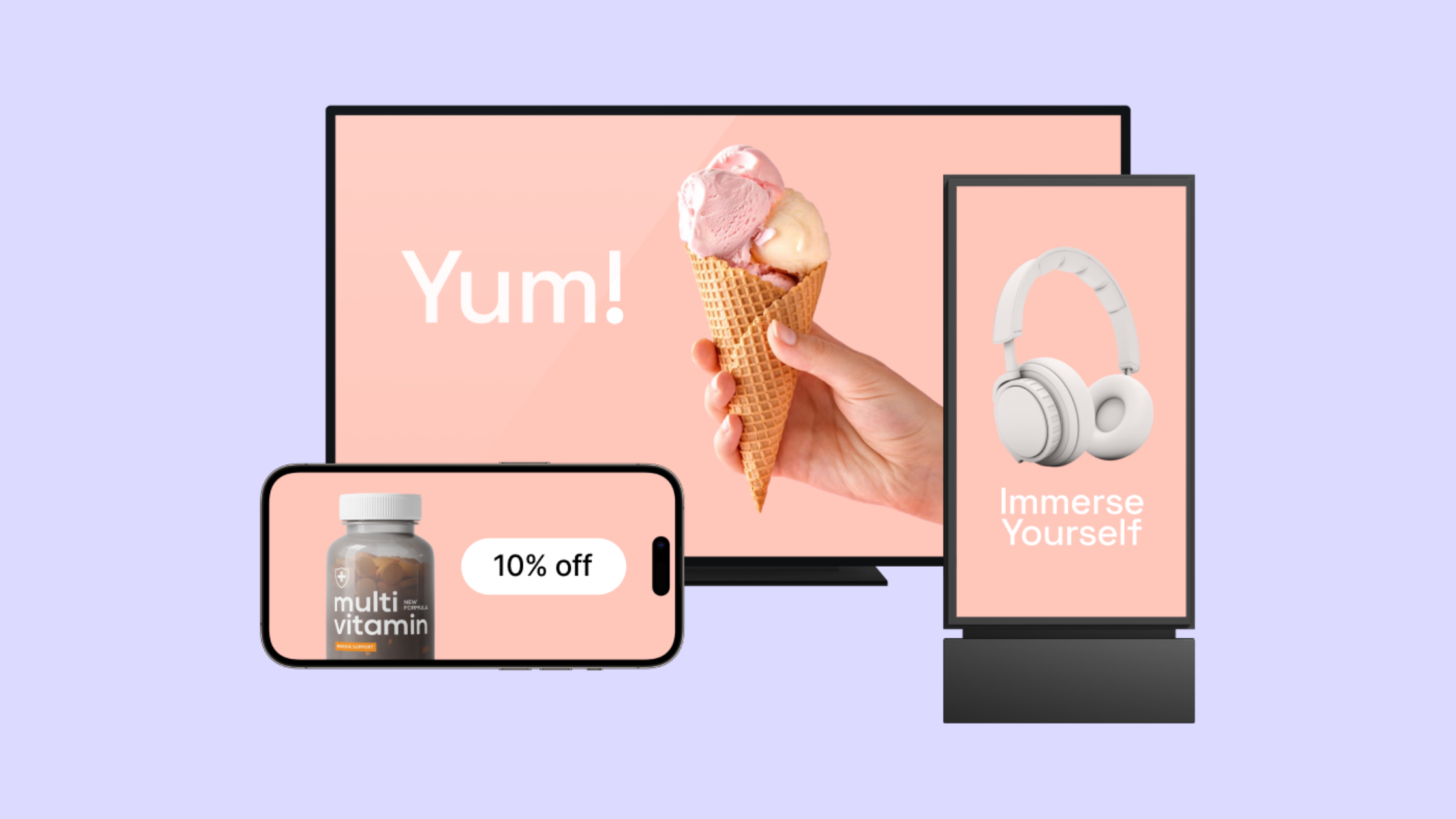

CTV

When we talk about CTV, pre-roll and mid-roll in-stream ads get the highest eCPMs as well as fill rates. Non-skippable ads (15-30 seconds long) are especially effective for brand awareness and storytelling, thanks to their high-impact, full-screen format.

As an emerging channel, CTV is also home to one of the most flexible and innovation-friendly ad markets. Publishers are testing new ad formats like QR-based ads, shoppable ads, and SKOverlays. Sponsored display ads, which are shown when the content is on pause, is also a new ad format trending among CTV publishers.

DOOH

DOOH is a powerful way to reach large and diverse audiences. Big screens in high-traffic areas drive significant brand attention — and, in the case of shopping malls, can even lead to offline purchases.

Both video and display formats work well with DOOH. However, challenges remain around addressability and targeting given the nature of DOOH environments and the frequency of impressions.

Which metrics most affect ad performance on each channel?

- In-app: CTR, device ID pass-through, SKAdNetwork 4.0 support, auction type (bidding/waterfall), OM SDK support, GDPR/COPPA compliance, refresh rate, ad clickability area, support for network end cards, StoreKit auto-opening, multi-ad size/multi-ad format enabled, first-party data (age/gender), availability on alternative app stores (Amazon, Huiwei, Xiaomi)

- Web: personal ID availability, universal ID support, and type of integration (direct/indirect), multi-ad size/multi-ad format support, ads.txt implementation, mobile vs. desktop traffic ratio

- CTV: view rate, win rate, top geos, channel content, video length (30+ seconds), VCR, content object passed (rating, language, genre, channel ID, etc.), auction type (PMP/OMP), pricing flexibility

What’s the most efficient ad format today — and why?

Video and display remain dominant across all channels. Display is a sweet spot, with a wide range of formats that balance reach and performance without disrupting user experience. Video, meanwhile, is still in high demand from advertisers looking to make a visual impact. Last year alone, mobile video ad spending growth surpassed 26%. So, incorporating those will often lead to great fill rates.

In-app rewarded video is a performance powerhouse, especially in gaming and utility apps. It offers a clear value exchange: users opt in to watch an ad in return for in-game rewards or app benefits. This drives higher engagement, better completion rates, and increased eCPMs — all while delivering measurable outcomes for advertisers.

As audiences increasingly shift to streaming, CTV is emerging as premium inventory in high demand. In fact, non-pay CTV households will outnumber pay TV households in the US this year. These ads offer high completion rates and attract significant brand budgets, giving publishers a valuable new revenue stream.

A/B testing

Is A/B testing important in ad monetization?

Absolutely! But at Verve, we take it further with a holistic approach to revenue optimization.

Every publisher, every app, and every audience is unique. We test and experiment with live traffic to see how our demand reacts and determine optimal bid floors or eCPMs. The same applies when we talk about in-app, where we check what performs better within the specific app and ad format: in-app bidding, waterfall, or both combined.

Is it risky for publishers to run tests?

Not really. In waterfall setups, we receive eCPM expectations directly from publishers. Our analytical system then provides precise revenue estimates based on volumes, ad formats, inventory type, integration, and top geos. We suggest optimal placement in the waterfall using our current top, average, and bottom floors.

When it comes to in-app bidding, it’s even more straightforward: we just set the recommended floors so our demand can bid appropriately. That’s it. While the waterfall may be fading, we strongly believe that hybrid setups combining both models deliver the best revenue outcomes.

Any more questions?

The best-performing ad format depends on the channel. At Verve, we support all major channels (web, in-app, CTV, and DOOH), and we are format-agnostic. That means whether you’re focused on video, display, native, in-game, or even audio, we’ve got you covered.

If you still have questions about which ad formats are right for you, or how to get more from the formats you already use, I welcome you to get in touch.