Following up on our iOS 14.5 trend article published in July, we’re now looking at the most recent updates to adoption rates of iOS versions 14.5+, IDFA opt-in rates, and the fluctuation of eCPMs by operating system on Verve’s mobile exchange.

iOS 14.5+ is hitting a critical mass

Back in June, 70% of requests on our exchange originated from iOS versions 14.5 and above. That number rose to 82% by the end of August. The adoption of version 14.7 on our exchange was significantly faster than its predecessors, as Apple seems to have found confidence in rolling out the new versions to more users right away. In conclusion, iOS 14.5+ is hitting a critical mass.

Opt-in rates are stagnating

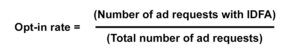

According to industry reports, opt-in rates around the globe still fluctuate from 17% to as high as 41%. To understand these numbers better, the underlying methodologies also need to be taken into consideration. As an exchange, our means of measuring opt-in rates differ from a mobile measurement partner’s (MMP) user-based opt-in calculations: we measure iOS opt-in rates based on the number of ad requests hitting our exchange with a distinct IDFA, divided by the total number of ad requests we receive.

As a result, we recorded a 28% opt-in rate at the end of August. Since May, the opt-in rates have remained rather stable with a small day-by-day deviation of 2% to3%.

By looking at incoming ad requests instead of checking opt-in rates at a user level, we can paint the true picture of the impact of iOS 14.5 (or traffic without identities) on programmatic ad revenues or advertising spend.

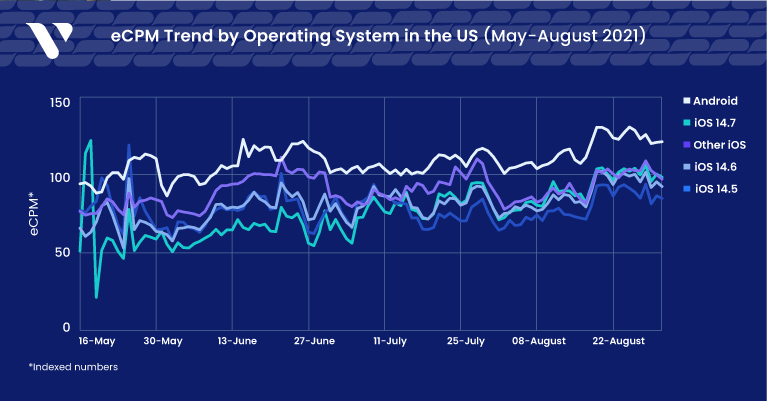

Android takes first place in the eCPM race

Android eCPMs in the US have surpassed iOS eCPMs as early as May. Ever since Android eCPMs are on average 20% higher than the eCPMs we record for iOS.

Overall, we have observed an upward trend for eCPMs, impacted by seasonality, across the exchange. Still, Android holds the upper hand in terms of profitability for publishers and proves its value with an unbeatable reach of addressable consumers for advertisers.

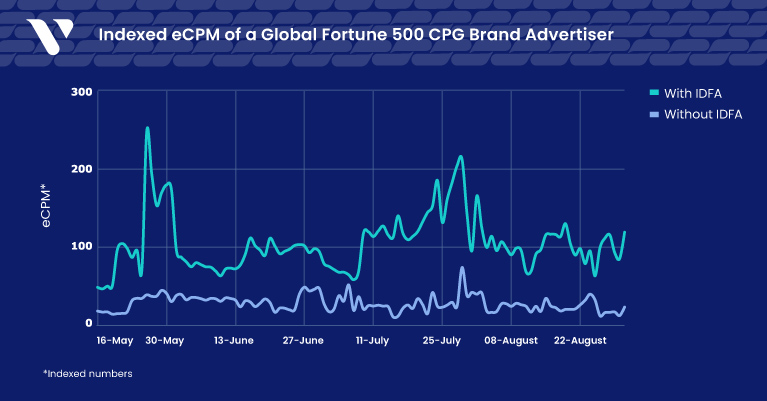

Brand advertisers react: eCPMs for opt-in traffic are climbing

And speaking of addressable consumers, the race to reach these coveted audiences is on. We see that brands are willing to spend up to three times more pm traffic with access to an IDFA, especially in the food, drinks, and quick service restaurants (QSR) ad categories. For these brands, identifiable customers seem to hold more value than anonymous audiences.

Performance advertisers are testing the waters

Performance advertisers, on the other hand, seem to run different mobile programmatic advertising strategies.

Based on the past few months, we see two distinct spending behaviors:

- Mobile gaming advertisers who initially focused on buying IDFA traffic are slowly increasing spend on traffic without identifiers. However, the eCPMs for opt-out traffic are still lower than half of the eCPMs paid for opt-in traffic.

- Performance advertisers from other categories offer similar eCPMs for both opt-in and opt-out traffic. These eCPMS remain stable over time. However, over the course of the last three months, we saw periods of three to four weeks in which eCPMS for opt-in traffic increased temporarily. These periods seemingly mark test runs matching the performance of campaigns targeting unidentifiable users against their addressable counterparts.

As a side note, we see that gaming app categories such as casual games still send a high share of requests (around 75%) with an opt-in status set to “not determined”, meaning that those users haven’t been shown a prompt yet. Therefore, IDFA might be a rare piece of data to come by for performance advertisers focusing on these app categories.

The future of mobile advertising is in the hands of the user

The reach that is associated with mobile identifiers is dwindling. Of course, there will always be a share of users who value or don’t mind sharing their identifier for advertising purposes. However, as of today, that number seems to make up only one-third of the global user base, with privacy regulations becoming more strict around the world.

Therefore, the benefits of creating a support system of alternative privacy-based solutions for both advertisers and publishers are as clear as day.

- Publishers who support the ecosystem by supporting privacy-first solutions and enriching the bid stream with contextual signals will safeguard their ad revenues.

- Advertisers who build a solid foundation consisting of more than just identifier-based solutions can stabilize the reach of their target group and return on ad spend (ROAS).

Verve can help you reach your customers in a world without identifiers. To get started, reach out to us today.