Free Ad-Supported Streaming TV: The best bet in CTV advertising

TV is the most powerful advertising channel in the house, but the way people watch it continues to evolve.

The subscription streaming boom of the past decade gave rise to an entire generation of on-demand binge-watchers. But after years of price hikes, account sharing crackdowns, and too many streaming subscriptions to manage, consumers are rethinking their habits. Increasingly, they’re turning to free, ad-supported TV (FAST) and AVOD platforms.

For advertisers, this shift represents one of the most exciting opportunities in years: a growing audience, a premium environment, and more efficient media investment.

The FAST boom

FAST viewership is surging in 2025, and the numbers tell the story:

The number of households watching FAST at least monthly grew 12% YoY.

Average daily FAST viewing hours per household grew 16%.

The time viewers spend watching a single channel increased 25% YoY.

FAST has shifted from curiosity to habit as viewers adopt it as a primary way to watch TV. And as time spent grows, so does ad engagement.

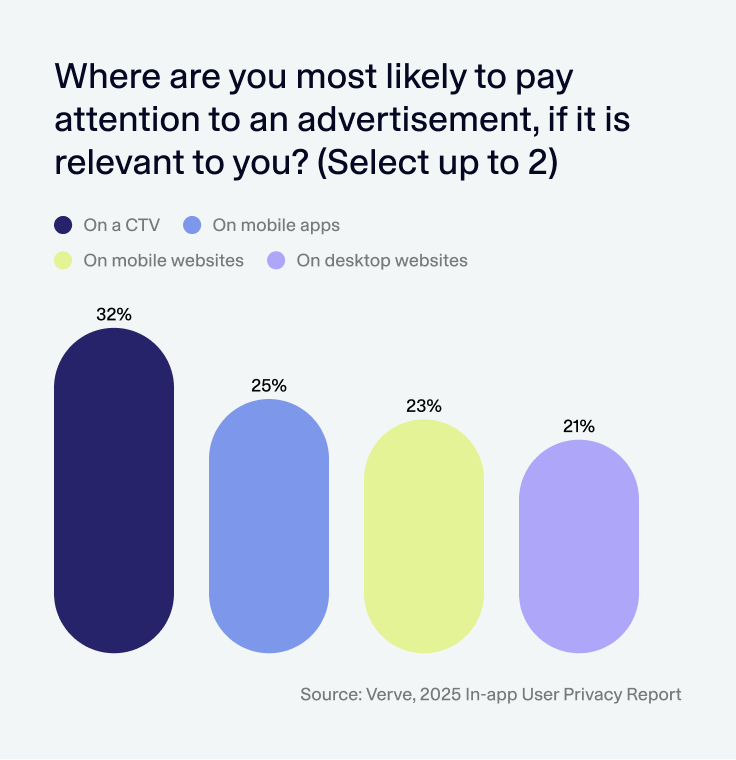

According to our 2025 In-App User Privacy Report, CTV is the channel where consumers say they pay the most attention to relevant ads (more than mobile or desktop). Viewers are receptive, especially when ads feel aligned with their interests or the content they’re watching.

Today’s FAST platforms — like Pluto TV, Tubi, and the Roku Channel — are now delivering premium, lean-back experiences with a blend of live channels, on-demand libraries, and familiar content.

Cost pressure meets content preference

The streaming market is reaching a tipping point. Subscription fatigue is real, and it’s about more than just the price. FAST’s appeal goes beyond being “free.” It’s become the right solution for a streaming market that’s increasingly fragmented and expensive.

In 2025, subscription streaming costs have risen faster than inflation (CPI inflation averaged about 3.3% since January 2023, while SVOD prices grew 12.6% per year). With multiple platforms competing for monthly fees, subscription fatigue is driving viewers toward free, ad-supported options where they can enjoy premium content without juggling payments and passwords.

FAST combines the ease of linear TV (curated channels, lean-back watching) with the choice and flexibility of streaming. The result is an environment where ads feel natural. Nearly half of CTV viewers (47%) even say they like interactive TV ads, which invite engagement rather than interrupt it.

This is a pivotal shift for advertisers: consumers are actively opting in to ad-supported experiences when those experiences deliver value and relevance.

Why advertisers should care

FAST sits at the intersection of premium storytelling and data-driven precision. This is a rare sweet spot for media buyers.

Unlike traditional TV, where reach often comes with limited targeting, FAST can provide granular audience data, contextual targeting, and transparent reporting. It’s where brand-building and performance can finally coexist.

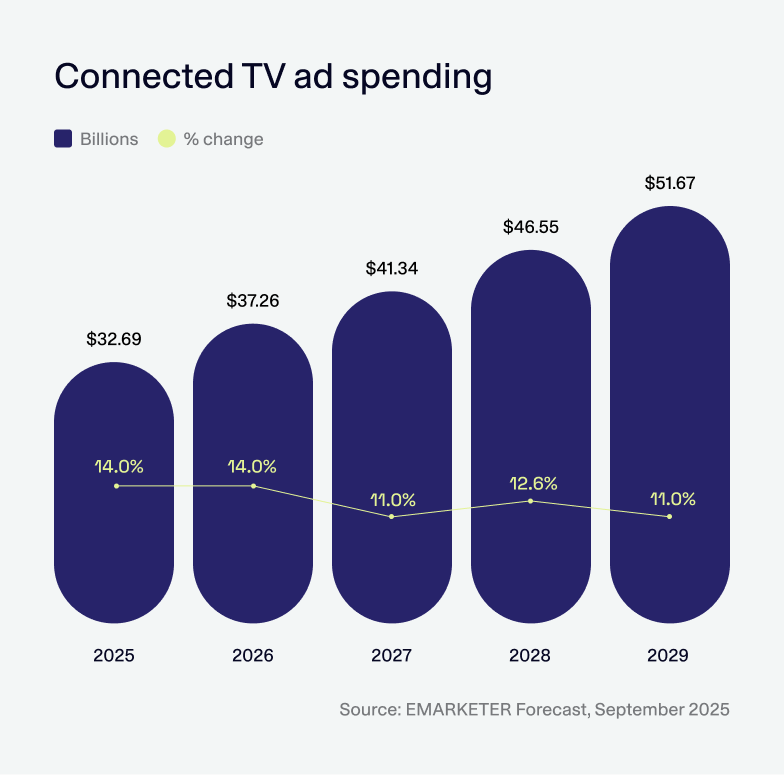

Advertisers are taking notice. eMarketer expects CTV ad spending to grow more than 10% year-over-year through (at least) 2029, driving largely by investment in ad-supported streaming. The tools that have made digital advertising so effective are now redefining how TV works. That’s why CTV media buyers plan to increase spending the most in “programmatic buying” and “audience data/targeting” over the next 12 months.

Meanwhile, demand is not keeping up with the rising supply, which means CTV CPMs have remained relatively low considering the potential impact. This gives advertisers a chance to secure scale efficiently before demand catches up.

For marketers seeking trusted, high-quality environments that deliver both storytelling and performance, the FAST opportunity is clear.

Follow the audience

The migration toward ad-supported streaming isn’t slowing down — and the money is following the viewers.

Remember a few paragraphs ago when we said that CTV ad spending is growing? Well, that spending is forecast to surpass linear TV by 2027 (with FAST and AVOD taking a growing share of that investment).

Early adopters are gaining a strategic edge by building brand familiarity, optimizing creative for the lean-back experience, and experimenting with interactive formats that boost engagement.

The next phase of growth goes beyond cord-cutting to audience recentering. Viewers are deciding what kind of ad experience feels worth their time, and FAST delivers exactly that balance.

How advertisers can act now

FAST isn’t just a new channel; it’s a smarter way to approach connected TV. Here’s how advertisers can capitalize now:

- Test across multiple FAST platforms. Each has unique audiences and content strengths. Compare engagement rates to identify where your brand resonates most.

- Invest in audience data and programmatic tools. Smart segmentation and targeting turn FAST from an awareness play into a performance channel. Check out Verve’s CTV packages for easy and effective targeting.

- Leverage creative innovation. Interactive or sequential CTV ads perform strongly with engaged viewers, especially the 47% who say they like participating.

- Measure attention, not just impressions. Use metrics like session duration, completed views, and engagement to understand the true impact of your campaigns.

- Plan early for holiday and tentpole moments. Inventory competition will rise as brands recognize FAST’s effectiveness.

As FAST matures, advertisers that start experimenting now will be better positioned with sharper insights, more efficient buying strategies, and first-mover credibility.