The Evolving Privacy Mindset: What 2025 data reveals about user willingness to share

We’re now spending about a quarter of our waking hours looking at our phone. Every tap, scroll, and search generates a wealth of data, reshaping how publishers monetize apps and advertisers reach audiences.

But the old playbook of unlimited data access no longer applies. Under the pressure of privacy regulations and controls like Apple’s App Tracking Transparency (ATT), users now hold more power than ever. The industry has adapted over the past decade since GDPR, phasing out personal identifiers and experimenting with privacy-first alternatives.

Still, one question looms large: what do users actually think about sharing their data?

To find out, we surveyed 4,000 consumers in 2025 across the US and UK, compiling the results in our 2025 In-App User Privacy Report. The responses reveal not just shifting behaviors, but a more sophisticated privacy mindset that publishers and advertisers must understand to thrive. Read on for a preview of the insights available in the report.

Knowledge is power

The strongest predictor of whether users share data is whether they understand how it’s being used and feel in control of it.

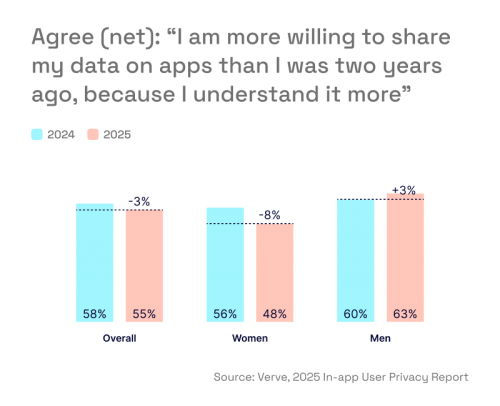

- Knowledge builds confidence: About 55% of respondents said that having a stronger understanding of their data makes them more likely to share it than two years ago.

- Demographics matter: Men reported higher comfort levels over time (+3 points year-over-year), while women became more cautious (–8 points).

- Generational gaps are stark: Nearly 76% of 25–34-year-olds felt confident about their data understanding, compared to just 38% of those aged 55+.

The takeaway? Education matters. When platforms communicate clearly and give users confidence, willingness to share rises. But without transparency, caution takes over.

Privacy controls work, but trust is slipping

On paper, privacy controls look like a win: 65% of consumers say better controls make them more likely to share data.

The catch: that number is down from 68% in 2024, with sharper declines among younger users (16–24) and middle-aged groups (45–54). Even when controls exist, many users still avoid engaging with ads altogether. On CTV, for example, one in three respondents who felt “more in control” still refused to interact with ads due to privacy fears.

What data do users share, and where?

Consumers are not uniformly “for” or “against” data sharing. It all depends on context.

CTV

Surprisingly, this was the environment where users were most willing to share email addresses. Simplified login flows (QR codes, cross-device authentication) reduce friction and encourage opt-in.

Mobile apps

Users were most open to sharing details like name, region, gender, or age/date of birth. Mobile numbers were also more commonly shared here than elsewhere.

Mobile web

The least favored environment, likely due to clunkier user experiences and weaker trust signals.

Context drives decisions. Where the user experience feels natural and valuable, willingness to share rises.

Mobile app categories: A tale of trust

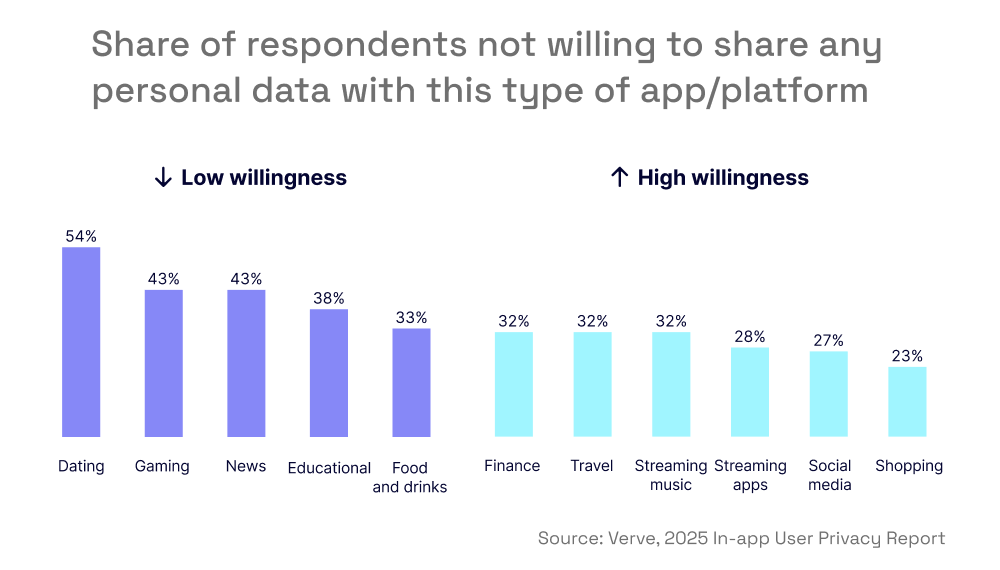

When it comes to mobile apps, user attitudes vary sharply by category.

- Least trusted: Dating, gaming, and news apps saw the lowest willingness to share. Users see little connection between these apps’ functions and requests for personal data.

- Most trusted: Shopping, social media, and streaming apps fared better. In these contexts, data-sharing is often practical—think shipping addresses for e-commerce or login details for streaming.

This shows a key shift: users are selective, not hostile. They judge each request against whether it makes sense for the app’s purpose.

A sophisticated privacy mindset

Comparing 2024 to 2025, it is clear that consumers are moving beyond simple “yes” or “no” responses to data requests. Instead, they’re developing a more nuanced, case-by-case approach:

- More protective of highly identifying details (names, phone numbers, contact info).

- More open to demographic or contextual data (location, age, interests) when it unlocks relevant experiences.

- More selective overall, sharing strategically rather than reflexively across apps and platforms.

This emerging mindset means publishers and advertisers must earn trust with every interaction.

What this means for publishers and advertisers

The survey findings underscore three strategic imperatives:

1. Educate and empower

Clear explanations and user-friendly privacy controls directly boost willingness to share. Don’t assume users understand your practices—show them.

2. Align requests with context

Asking for the right data in the right place strengthens trust. Irrelevant asks raise skepticism and risk churn.

3. Design for selective sharing

Expect users to say “yes” to some data and “no” to others. Build monetization and targeting strategies that thrive without overreliance on personal identifiers.

Want more?

The era of casual data collection is over. Users understand their power, and they’re exercising it with growing sophistication. They are not anti-advertising or anti-data. They are pro-value, pro-control, and pro-transparency.

Hungry for more data? Download the 2025 In-app User Privacy Report for additional insights, such as user monetization preferences, the effects of relevant advertising, and consumer concerns about AI.