Connected TV isn’t just about reach. It’s also one of the most engaging ad channels out there — and game and app marketers are taking notice. But can CTV really drive user acquisition? The short answer is: yes. With over three-quarters of the US population using a second-screen while watching TV, CTV presents a prime opportunity to capture attention where it matters — on both the big screen and the smartphone. But how can gaming apps tap into CTV to drive real results? We’re going to break down how performance CTV fits into a user acquisition campaign and what the challenges and potential solutions are. Stick around, and we’ll also share how we’ve successfully helped app marketers turn CTV into a powerful UA channel.

Editor’s note: This post was originally published June 2023 and updated in March 2025

Definitions: Linear TV vs. CTV vs. OTT

Because CTV is a newer performance channel for mobile apps and games, it can be helpful to brush up on some of the jargon. Let’s set the context from the start.

Linear TV is traditional broadcast television with scheduled programming. Ads are served during predefined commercial breaks and sold in advance, usually as part of a bigger campaign.

CTV (Connected TV) refers to internet-connected devices used for streaming video content, such as smart TVs, streaming boxes (e.g., Roku, Apple TV) or gaming consoles. CTV provides both on-demand and live viewing services. It also allows for programmatic ad buys.

OTT (Over-the-top) is internet-based video content delivery, bypassing traditional TV providers. It includes services like Netflix, Hulu, and Amazon Prime Video, accessible on CTV devices, smartphones, and more. OTT provides on-demand content with subscription or ad-supported models, revolutionizing TV consumption. CTV is a subcategory of OTT.

Why use CTV for performance marketing now?

For a marketer looking to drive installs, turning to CTV for performance just makes sense. This year, nearly 87% of households will be reachable via CTV.

Marketers should always follow the consumers. Consumer attention is shifting more and more from traditional TV to connected TV and on-demand streaming. The rapid growth of FAST (free ad-supported streaming TV), SVOD (subscription video on demand), and AVOD (ad-supported video on demand) makes this transition much easier, even eating up some attention from the UGC (user-generated content) on social media.

Alexei Moltchan, Vice President, Product at Verve

While linear TV has been historically a brand channel for publishers, CTV’s advantages make it a compelling option in the mobile marketing mix as a performance channel.

-

- Targeting: More precise targeting options help advertisers reach specific audiences based on demographics, interests, and behaviors. This increases ad relevance and the game’s/app’s chances to drive installs (or re-engagement, in the case of retargeting).

- Measurement: CTV allows for more detailed analytics and tracking options (compared to linear) to assess campaign effectiveness. However, measuring CTV’s impact on app installs has an important distinction from other channels: Rather than looking at last touch and attributing installs directly to CTV, many marketers are choosing the full-funnel approach. Major mobile measurement partners (MMPs) are recognizing this need and are evolving to support proper CTV measurement within the full-funnel paradigm.

- Ad formats: CTV offers new and engaging ad formats that can easily convert viewers to customers. For example, interactive shoppable ads allow people to make direct purchases. With these new capabilities, 7% of US adults have already made a purchase via CTV — and while this number might seem small, it will rise quickly in the coming year as more than half (53%) of CTV viewers wish TV ads had a simple purchasing option.

Leveraging CTV in campaigns isn’t restricted to big brands with hefty marketing budgets like is often true for linear TV. Although CPMs from CTV are still higher than channels like display and social, the impression quality often exceeds that of traditional TV CPMs. And there’s good new: as more streaming platforms now offer ad-supported subscription tiers, this is steadily reducing CPMs, making CTV a much more accessible channel for advertisers of all sizes and budgets.

How does CTV fit into the mobile or gaming marketing mix?

There are strong signals in the market of CTV being a channel for driving incrementality and working as an amplifier for other channels. Connected TV has proven as a powerful tool to move users down the funnel where they convert via other channels.

Big screens with no skip option are expected to eventually lead to high impact. Now that it can be measured, we have a chance to evaluate CTV's efficiency within the full funnel.

Clara Markovich, Entrepreneur in Residence at Verve

Isolating CTV from other channels and relying on last-touch attribution would be misleading because most ad formats are not clickable, and the advertiser has limited control over which channel is the last one to contribute to that install.

Measurement and attribution

Major MMPs are recognizing the market’s need to measure CTV performance for gaming and app user acquisition, and are moving forward with a solid roadmap of CTV measurement features, although at a different pace.

User journeys come in so many shapes and sizes. Here are just a few common examples:

- CTV ad includes a QR code, which brings user to a mobile app store via deep linking.

- CTV ad is seen, user searches on app store, and the resulting install gets attributed to organic, according to last-touch method.

- CTV ad is followed up with a banner ad on mobile, which becomes the last touch.

This all brings us back to the fact that the only correct approach to measuring CTV performance is looking at it from the full-funnel perspective. Advertisers and vendors turn to look at custom signals and report on assisted installs, measuring incrementality, and even MMM (media mix modeling).

Measurement in CTV is evolving fast, but that shouldn’t stop app marketers from testing the waters. With the right setup and a full-funnel view, CTV doesn’t just drive awareness — it can be a meaningful performance channel that complements your UA strategy.

Colby Bone, Business Development Director - CTV at Verve

Newer apps and games may be tempted to ignore the channel due to measurement complexity and perceived high costs. However, as you gain traction and establish benchmarks in your monetization journey, CTV can boost your media mix and lead to improved performance.

How are measurement platforms supporting CTV measurement?

Verve has tested most CTV-supporting MMPs while running campaigns for our partners, enabling us to advise on the best MMP options for CTV. We also work closely with advertisers and MMPs of their choice to ensure the best possible quality of measurement.

AppsFlyer, Adjust, Singular, Kochava, and Branch are all offering certain functionality to support their publisher partners in exploring the CTV — though not all MMPs are created equal. In terms of features and pricing, Adjust now offers a CTV-specific dashboard as an add-on solution.

Other notable measurement tools are the ones providing incrementality measurement (e.g., INCRMNTAL) and media mix modeling (e.g., MetricWorks).

Creative is key: Best practices for CTV ad creative

CTV ads need to be next-level compelling in order for the user to take action.

Best practices:

- Unsure whether to invest more in CTV? Start by adapting your existing creatives — but keep in mind that web creatives may not perform quite the same on CTV.

- Make the ad entertaining — after all, entertainment is what your audience came to CTV for. Try gamification and incentivizing the user as this leads to higher engagement with the ad.

- CTAs, QR codes, logo presence, and app store icons. Make sure it’s extremely clear that this is an ad for an app/game, and what exactly the audience needs to do (clear, crisp CTA).

- Humans in the picture + catchy voiceover (important because sometimes your user is not watching but you can still engage them with the sound).

- Test different storylines and ad video lengths. Typical video ad is 15 or 30 seconds, but they can also be as short as 6 seconds and as long as 2 minutes.

Buying performance ads on CTV

In a nutshell, there are two main categories of how to buy CTV supply:

Direct: negotiating and transacting on your ad placement directly with the publisher (a streaming service such as Hulu, or a device manufacturer like Samsung). This approach limits work to specific partners, or the advertiser typically needs to work with each of the partners independently, which results in higher workload. But on the positive side, you will get info that you don’t get in the bidstream (like content itself).

Programmatic: buying video inventory across many different networks in an open auction, opting for a private marketplace (PMP) deal, or via a DSP. Programmatic buying offers more and better capabilities for optimization and measurement. This lightens the load for media buyers, especially for more complex multi-channel campaigns.

Our advice: Go programmatic

With CTV being a newer kid on the performance block, it’s best to start with a trusted adtech partner. This unlocks better optimization and measurement capabilities while having access to a whole range of supply partners, which allows for better balance of inventory quality and cost.

Partner for successful CTV performance

Look through a partnership lens when you’re deciding how to use CTV for user acquisition: You are not after cheap installs there, but rather after a solid stream of quality and brand-safe impressions that will integrate into the marketing mix and drive installs.

Find the partner who will work with you to understand investment and metrics first, then work on targeting, creatives, and testing to drive ROAS.

On the campaign side: Work on reducing cost per install (CPI), improving traffic quality, and driving positive ROAS.

On the app side: Exchange feedback on traffic quality (retention, in-app spend, ROAS, LTV predictions, etc).

On the measurement & attribution side: Collaborate to find the best approach with your current MMP. Partners should be knowledgeable about the possibilities and limitations of different MMPs and be integrated with top ones doing CTV measurement.

Getting started with user acquisition on CTV: KPIs

How do you know whether your CTV advertising is working for your user acquisition goals? Here are some helpful key performance indicators (KPIs) to keep an eye on:

Cost per install (CPI)

Starting with a CPI monetization model on CTV is a logical move. Why?

- CPI allows for simpler optimization and decision-making during the test phase. By focusing on minimizing the cost per install, publishers can assess the performance of different ad creatives, targeting strategies, and placements.

- CPI simplifies the optimization process and enables quick adjustments to improve acquisition efficiency.

- CPI also provides better control over budget allocation and forecasting.

Return on ad spend (ROAS) and lifetime value (LTV)

ROAS is an essential metric for measuring campaign profitability and long-term user value — however, it may not be the most suitable choice for tracking user acquisition on CTV. CPI is a more straightforward and actionable metric specifically tailored to the goal of driving installs and expanding the user base.

However, as the user acquisition campaign matures and revenue attribution becomes more reliable, transitioning to metrics like ROAS or LTV can provide deeper insights into campaign performance and long-term profitability on CTV.

Case study: CTV powers up user acquisition for Smadex

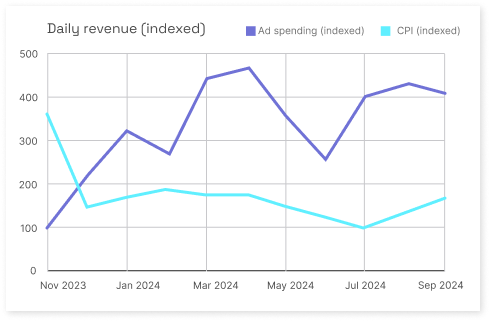

Last year, app marketers saw great success when Smadex, a performance DSP, partnered with Verve’s Brand+ Marketplace to enhance their CTV capabilities. Smaadex sought high-quality CTV inventory to complement their clients’ mobile UA strategies and improve ROAS.

By integrating with Verve’s premium CTV inventory, Smadex optimized performance and gained access to our pre-packaged CTV deals. The results were remarkable: Over the course of a year, monthly ad spending rose 299% while average monthly CPI decreased 55%. This meant a significant improvement in ROAS for Smadex’s clients. You can read the full case study here.

Let’s make CTV work for your UA strategy

CTV is a powerful piece of today’s user journey across multiple channels, often driving incremental performance rather than direct attribution. To make it work for you, consider a full-funnel approach that focuses on incrementality and assisted installs instead of rigid last-touch attribution models.

Yes, CTV can come with higher costs, but when the ROI is there, the spend is justified. Success depends on choosing the right DSP and measurement partners — ones that understand CTV’s complexity, offer broad supply access, and use sophisticated anti-fraud measures to balance cost and quality.

CTV isn’t a plug-and-play solution, but with the right strategy and partners, it can be a game-changer for user acquisition. Ready to get started? Get in touch, and we’ll guide you through how to acquire new users for your app or game with CTV.