Originally published on Medium.

In the last few weeks, there has been a considerable buzz around Apple’s IDFA announcement with myriads of articles predicting the apocalypse, death, or similar doom of the whole digital advertising industry for iOS. But is this really an apocalypse — or death of an 80 billion-dollar business? Quite the opposite.

Intro

On June 22, 2020, Apple announced its upcoming iOS 14 update, which, among other features, will include crucial privacy changes upon which much of the industry relies on. The privacy changes concern thereunder the IDFA (Identifier for Advertising), which will not be an automatic opt-in anymore but instead every app will have to ask for users’ explicit consent to use their data. The identifier was used as a common communication framework between networks, DSPs, SSPs, advertisers, publishers, and MMPs, working as a connecting tissue of data in the mobile ecosystem. This shared ID makes it possible for AdTech players to track users across apps, measure marketing campaign success, and for retargeting. However, just because these practices are the status quo, that doesn’t mean they are future-oriented and this is exactly what Apple wants to enhance — a more privacy-centered future.

The IDFA is not dead nor is it going to disappear completely — it is just becoming more privacy conformed by being explicitly opt-in which is a change everyone knew was coming. With iOS updates such as ITP in 2017 and location permission notifications last year, as well as the Chrome 3rd party cookies deprecation coming in 2022, changes to the IDFA were highly anticipated. On top of this, governmental regulations including the GDPR in Europe in 2018 and CCPA in California this year fueled these changes which are needed for a more transparent and privacy-focused advertising ecosystem.

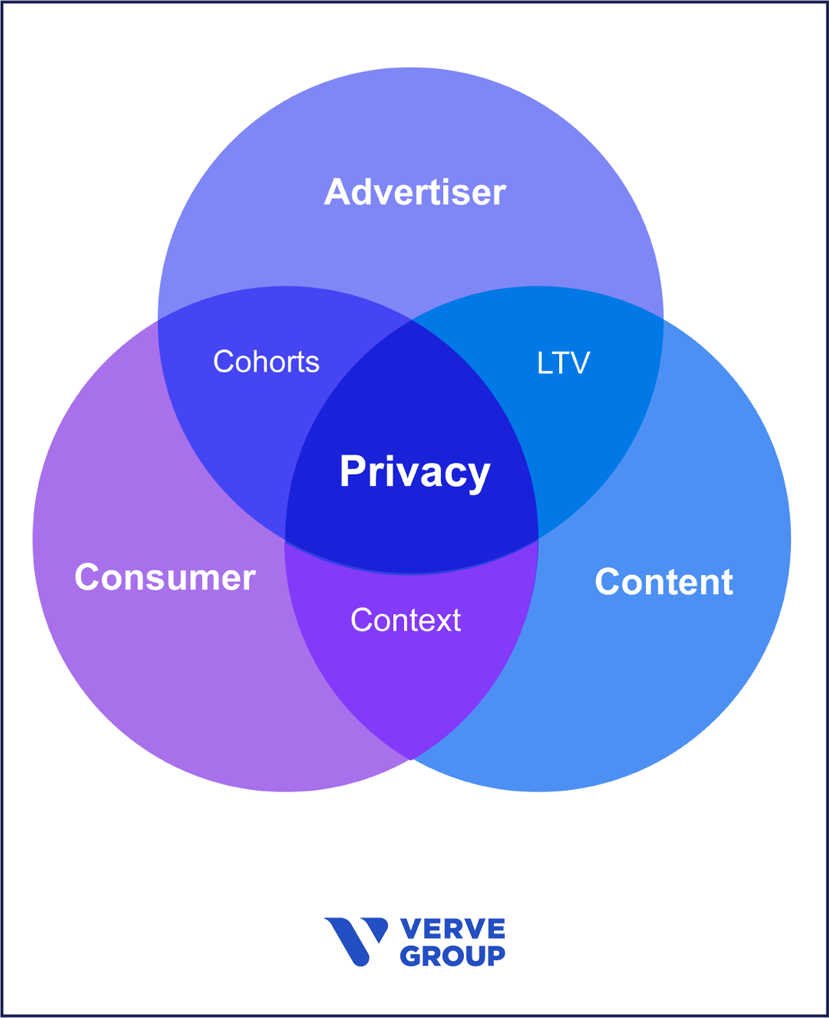

Instead of an apocalypse, this is actually a very important milestone. Privacy, advertising, and consumer choice finally meet to sustain a more efficient ecosystem.

User View

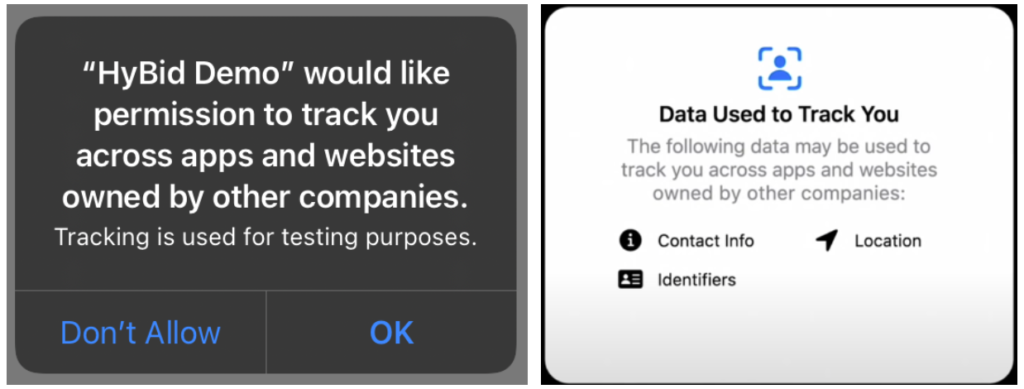

For the users, it starts with choice. There are already consent tools for those users who do choose to opt-in to tracking, and even though the rates are expected to be low, this group will become even more important. These tools include sign-in options, CMPs based on IAB’s TCF 2.0, or consenting to tracking via the OS.

Note: this is how our testing pop-up looks like

In practice, this means that users will not only see one new pop-up for each of the apps they use (I have 645 right now, this will be fun) — but also secondary pop-ups for logins or CMP-based consent. There are also emerging solutions for anonymized users who choose not to opt-in. SKAdNetwork (SKAN) is one of those, and we are working on what will probably be the first mobile audience segments built on privacy by design.

Depending on whether you are a publisher, performance or brand advertiser, for each, there are different aspects to focus on.

Publisher view

- For app publishers, the main points will be optimizing for higher opt-in rates, delaying the display of the default pop-up, utilizing tactics and tests, similar to what we’ve seen when optimizing push notifications, which have more than 50% opt-in rates- or location permissions. As long as the message and the value exchange is clearly explained to the users, we will see an increase in opt-ins after an initial sharp decline. Publishers will have to become creative about the consent pop-up for higher opt-in rates.

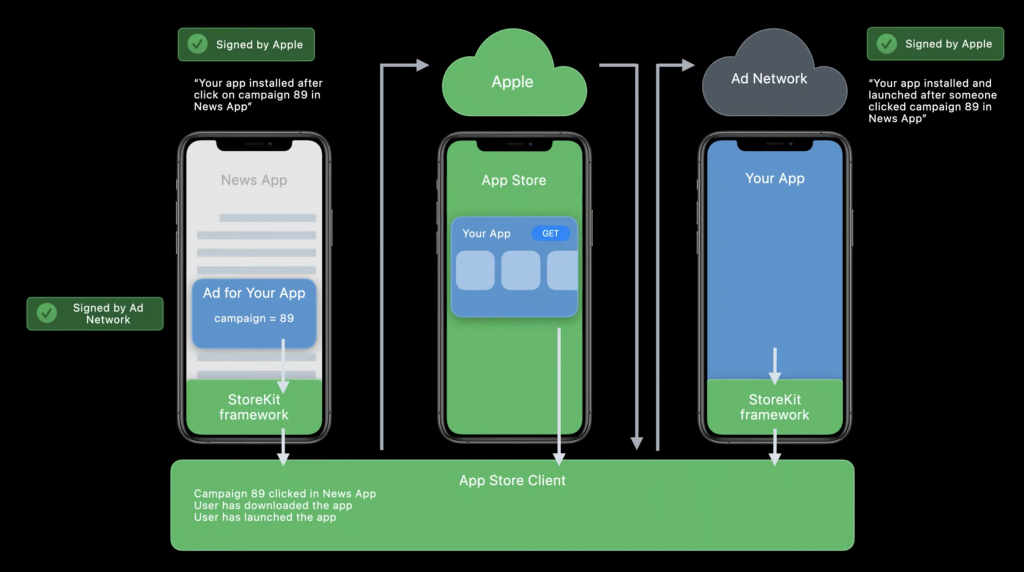

- For publishers depending on performance advertisers, out of which most are games, and high engagement units like rewarded videos or interstitials — there is the SKAdNetwork, which is an Apple solution. Even without the opt-in, the SKAdNetwork will provide aggregated and anonymized results. Though this part of the ecosystem will be less affected, its impact is not to be overlooked. Without the same level of targeting, advertisers and networks will need some time to adapt. Verve is also enrolled in the SKAdNetwork program.

- For those app publishers who depend mainly on brand advertisers — in verticals such as sports, weather, utility, messaging/social and others, it is crucial to find partners developing privacy-focused behavioral audiences on the device itself, and combine it with the contextual audiences, which is one of the main initiatives we are focusing on.

Advertiser view — Discussion: A tale of two ecosystems

The discussions about how advertisers will be affected have started to heat up and are meant to take place across various industry participants. The main goals are to support the progression of the open web, provide future-proof solutions for the ad-supported businesses and ensure that free content continues to remain available at scale while maintaining user choice and privacy preferences at front and center.

There are two easily identifiable parts on the demand side of this ecosystem — the Performance side and the Brand Advertisers side.

1. Performance advertisers (advertisers looking to acquire customers in-app)

A lot has been talked about the effectiveness of the SKAdNetwork and its impact on the industry. Apple’s SKAdNetwork API will collect data from ad clicks and send postbacks to advertising networks for app install and performance campaigns, with new parameters providing information on the source publisher and a conversion event. Mobile Measurement Partners will need to adapt to the new changes and re-envision their value propositions, as SKAdNetwork will provide the necessary reporting metrics.

Credit: Apple WWDC’20 keynote

I won’t insist on it here but I would like to guide you towards some of the best resources I’ve read for further discussions in case you haven’t stumbled across them.

- RIP IDFA: How to navigate a post-IDFA world with iOS 14

- Mobile Dev Memo — Eric Seufert on the IDFA changes,

- Podcast with Maor Sadra — Surfing in a Squall

Most SANs, (Self Attributing Networks,) and AdNetworks, (owning the full-stack → demand, tech, supply,) will see less impact, as mentioned above, and will be in a better position to adapt.

2. Brand advertisers (retailers, CPG, etc.)

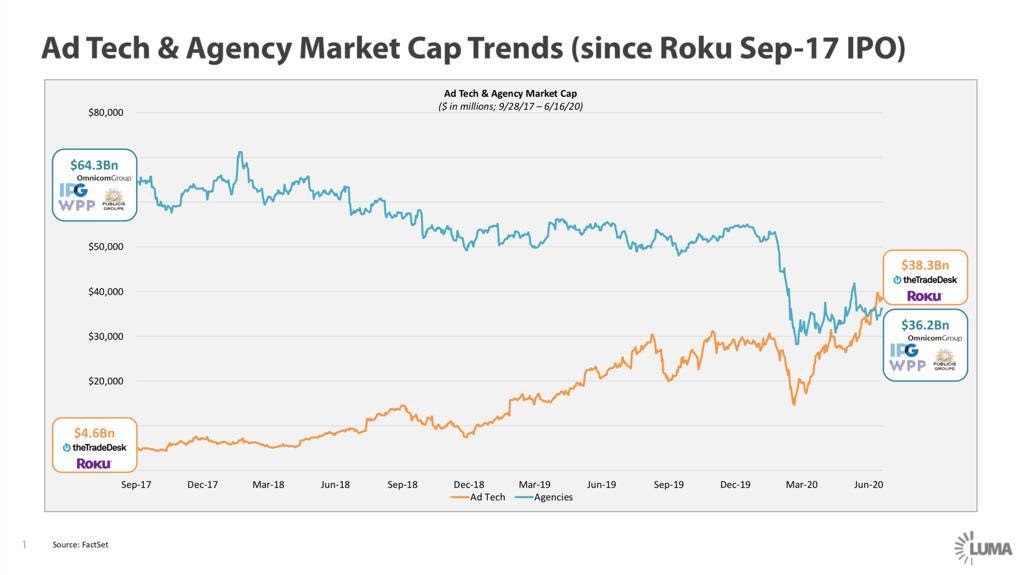

Coming back to the other part of the ecosystem — the bread and butter of the display world, the fuel for agencies, and funding for the open web. Namely the brands. The Coca Cola’s of the world, the P&Gs, the retailers, and the eCommerce. They came very late to mobile and will now find that Apple gave even less attention to their needs than the 5 seconds dedicated to the death of the IDFA.

Credit: Luma Partners

The audiences they rely on started to crumble not only on the web (Safari, Chrome) but have also been dealt another massive blow with iOS 14. It’s true that DMPs have been scrutinized before. With cookies dying in a few months and MAIDs disappearing — who will rise to the challenge?

Outro

I trust we can. And we are uniquely positioned to do so. We’ve been helping major DSPs and major SSPs navigate the mobile ecosystem via either our exchange bidding solution or our curated PMPs. We are now taking the learnings of building our in-house DMP and utilizing that to bring a wide array of audiences such as contextual, behavioral as well as location-context audiences directly on the device without compromising on users’ privacy choices.

As we progress we’ll release guides and materials for publishers, advertisers, and ecosystem partners (DSPs and SSPs) as well as progress updates on our solution.

In the meantime, we encourage you to reach out to us or your dedicated Account Manager if you would like to learn more about the steps we’re taking internally in preparation for iOS 14.