Retail Media: US, UK and Europe ecosystem, market size and definitions

Retail media is on the radar of anyone in the ad space as the “third big wave” of advertising. As a relatively new niche, retail media’s terminology and principles still lack a common understanding. Local and global organizations are working toward creating a common language around retail media and retail media networks and standardizing the terminology, measurement, and understanding of the ecosystem.

Here is Verve’s take on the “what, why, and how” of retail media in the US and Europe.

What is retail media and/or a retail media network (RMN)?

In a nutshell, retail media is a set of advertising options owned by and made available through a retailer. In this context, retailer is a broad term that simply means any company selling goods or services to consumers either offline or online.

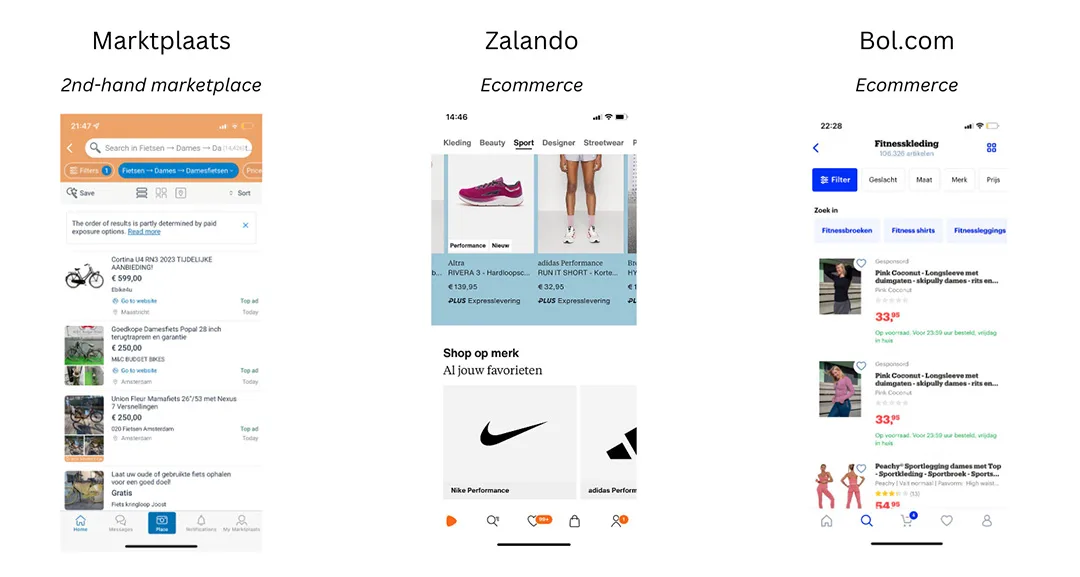

A retail media network is, therefore, a platform within an online store that allows brands to advertise their products to the retailer’s audience, while generating additional revenue streams for the retailer. Examples of RMNs include:

- US: Amazon, Walmart, Wayfair, Target

- UK: Boots, Tesco, and eBay

- Europe: Bol.com, Zalando, Ahold Delhaize, and Klarna

What are the advantages and main qualities of RMNs?

RMNs’ biggest advantage is customer data. RMNs operate as (almost) fully authenticated environments, because (either in an app or on the website) the customer is providing their email ID and often more PII data. On top of that, most retailers have a loyalty system that keeps their customers locked into their ecosystem.

In an increasingly cookieless/identity constrained advertising space, RMNs having this data becomes a critical value proposition, as it allows retailers an ability to target more precisely.

How big is the retail media market?

The online market share is growing at a steady pace globally. Retail media networks have two levers of growth — one being higher adoption rate and the other organic lever is the online/ecommerce market growth. The growth of RMNs is also powered by retailers moving up the funnel and expanding into video and CTV.

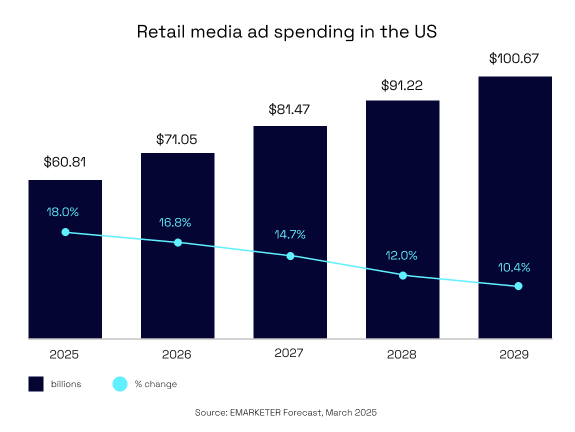

US retail media market

Retail media will be a $60 billion business in the US by the end of this year, accounting for almost a quarter of all US media ad spending.

UK and Europe retail media market

Retail media ad spending in the UK and Europe is also set to achieve consistent growth over the coming years. With 19% growth in 2025, the retail media market in the UK will surpass $5 this year. Europe, however, is seeing the most impressive uptick in retail media ad spending of all regions with 27% growth in 2025.

Who are the players in the retail media ecosystem?

In simple words, the ecosystem includes advertisers on one side, retailers on the other, and tech/data in-between.

The advertiser side of the ecosystem contains two types of brands:

- Endemic brands are those already selling their products on the retailer platform and using marketing options provided by the retailer to increase their visibility within the platform. Examples of endemic brands would be T-fal advertising on Amazon, or Nike having a highlighted spot on Zalando.

- Non-endemic brands do not sell their products/services through the retailer, but they still use the retailer’s data and ad capabilities to target their audience. Examples of non-endemic brands would be H&M ads within the Klarna (finance) app or travel deals within a real estate app.

On the retailer/publisher side of the retail media landscape, we find two major categories: traditional and digital natives.

- Traditional retailers have brick-and-mortar storefronts as well as media capabilities. Examples include Walmart, Target, Macy’s, Tesco, Boots, M&S, and Douglas.

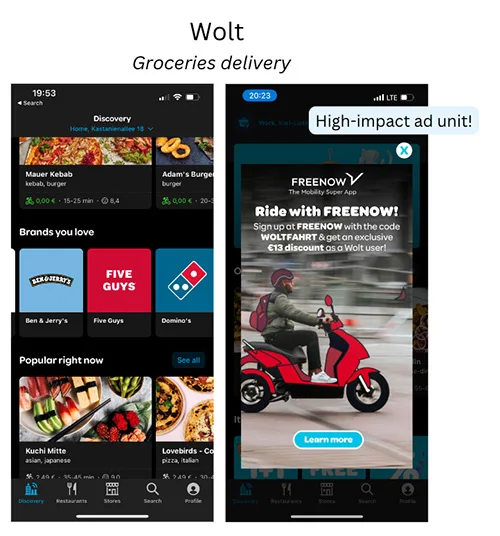

- Digital native retailers are businesses that have only existed online. Examples are extremely diverse in this category, including e-commerce/marketplaces (e.g., Amazon, Zalando, Bol.com, eBay, Marktplaats), finance apps (e.g., Klarna or Revolut), and those focused on on-demand services (e.g., Walt, Gorillas, Uber, Doordash, Lyft).

It is worth mentioning that one of the tasks for retail media networks is to acquire users for their platform and, therefore, for advertisers. This is where DSPs (including the Verve DSP) get their foot in the door, and where social media also comes into play.

What does the retail media mix look like?

Retail media is a centrally-important ad spending channel. The first-party data that underpins RMNs drives ad spending across a variety of digital channels, and retail media also utilizes a variety of ad formats.

On-site vs. off-site ads

On-site is anything that is advertised on the retailer’s owned inventory, be it website/app or any in-store inventory. On-site ad formats include sponsored listings, display banners, videos, email and push notifications, as well as (D)OOH, usually in the format of in-store screens.

Off-site are ads running on third-party inventory by the retailer (usually on behalf of their advertiser). The formats include paid search and shopping ads on platforms like Google, display banner ads and video ads on third-party sites, social media and CTV, as well as emails and push notifications. For example, Walmart would run Twitter ads for a brand sold through their website.

Online vs. offline ads

Online includes sponsored product ads, display (banner) ads and video ads. In apps, we see that the advertisers and retailers are not limiting themselves to specific formats. Although the sponsored product ads are more widely used, retailers are also experimenting with video and high-impact units.

Offline is, well, basically anything that is not online. This is usually digital out-of-home (DOOH) advertising in stores. Offline is also sometimes referred to as in-store retail media. In-store retail media presents a big opportunity for retailers with physical stores; however, it only accounts for a small piece of the retail media pie. In 2025, retail in-store ad spending will only account for less than 1% of total retail media ad spending.

What role do data clean rooms play in retail media, and who is already using them?

Data clean rooms are increasingly used by large retail media networks. They offer a great opportunity to combine retailer first-party data with publisher first-party data in order to drive lower acquisition costs and higher LTVs — all this without the risk of the data being resold or recaptured outside of the RMN. For example, US retailer CVS found that when they layer their high-fidelity first-party loyalty data over supplies data on an ad campaign, it can deliver a 2X sales lift.

What is the future of retail media beyond 2025?

The future looks bright — albeit with some challenges. The retail media network market is steadily growing by nearly 25% year-over-year. Retailers are excited about adding and enhancing a new revenue stream to their business with relatively low investment costs. Brands and advertisers are enthusiastic about the opportunity to access their target audience in a trackable, authenticated environment.

Nevertheless, an RMN is a walled-garden ecosystem, which poses major challenges for advertisers. Data access is often limited, and cross-platform measurement is difficult. Calls for RMN standardization are getting louder, which could ease this friction. However, it is most likely to be transparency from RMNs, rather than standardization, that will answer these calls.