In the digital realm, data is money. Users can pay for digital goods and services with their personal data — be it simple things like name and email address, or more intimate information like health data. And looking at the numbers, it’s clear that today’s users are highly motivated to trade their data for free content. About 97% of mobile apps are free, and the majority of those free apps rely on in-app advertising to pay the bills.

We surveyed 4,000 mobile users to find out how they felt about this value exchange — the results of which can be found in our In-app User Privacy Report. In this post, we’ll dive into one portion of those findings: Which users are the most willing to watch ads for free content? And which content motivates users to share their data?

Increased willingness to share data and watch ads

Today’s users are more knowledgeable than ever about the data-sharing process. Privacy laws have opened consumers’ eyes to their digital rights. Opt-ins have become more prevalent and transparent. And users are increasingly exercising the right to access their data.

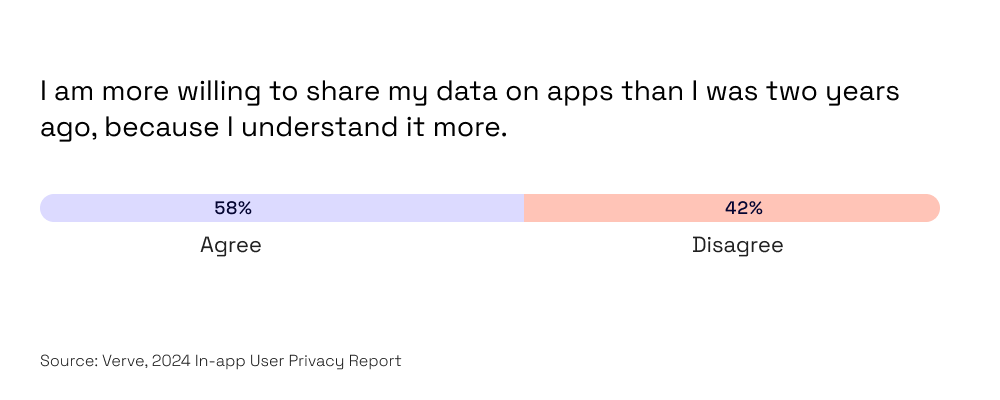

As a result, mobile users’ opinions on data sharing have evolved. According to our survey, 58% of respondents are more willing to share their data on apps than they were two years ago. (More on that later!)

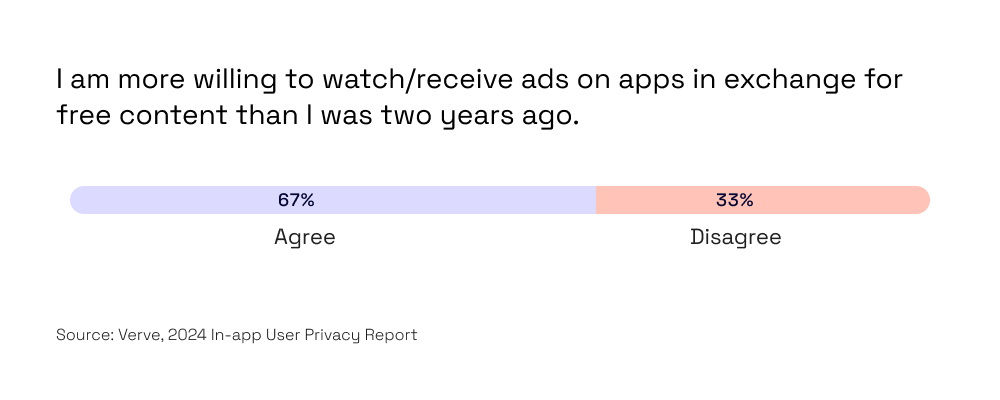

And with an improved feeling of control over their data and insight into how ads help fund app content, users are also more willing to receive ads for free content. 67% of those surveyed agreed that they are more inclined to watch in-app ads in return for free content than they were two years ago — and between those that agreed and disagreed with this statement, there were notable demographic differences.

Takeaway for advertisers

Consumers are particularly accepting of in-app advertising, as they are aware of the value exchange that is taking place. This makes mobile apps an ideal environment for your ads to be positively received.

Takeaway for publishers

Transparency leads to trust. Ensure consent requests list the exact purposes for specific kinds of data collection and benefits consumers will receive. In return, users will feel more comfortable opting in.Who’s watching ads for free content?

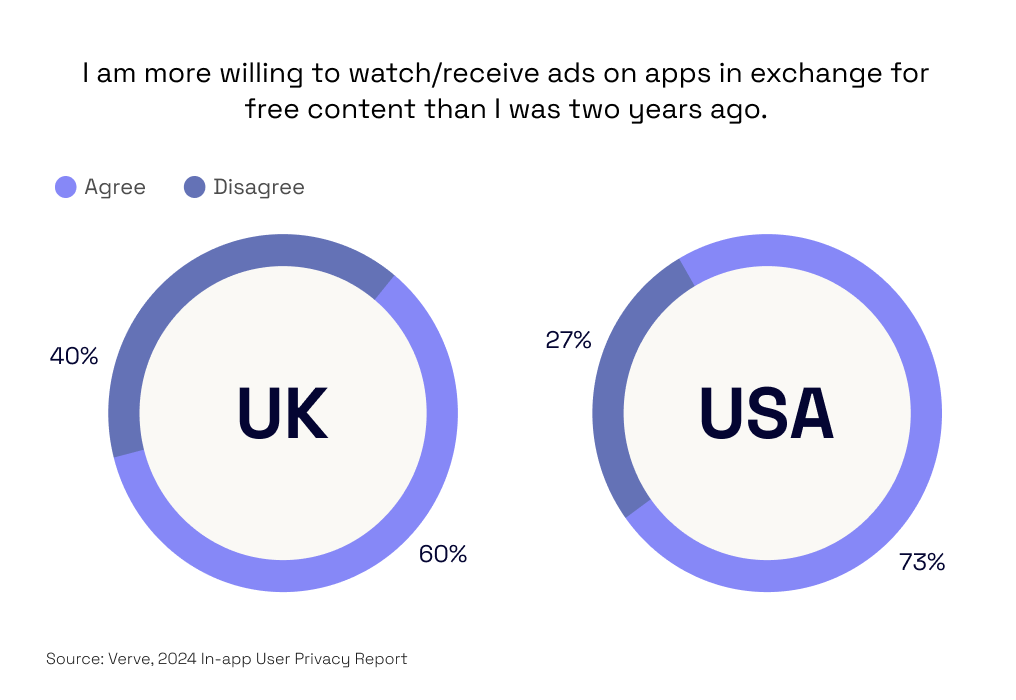

Our survey included users from the UK and the US, and although the majority of respondents in both countries agreed that they are more willing to watch in-app ads in exchange for free content than two years ago, those in the UK seemed to have a higher level of skepticism towards in-app advertising. Overall, there was a 13% gap in willingness to view ads for free content between these two countries.

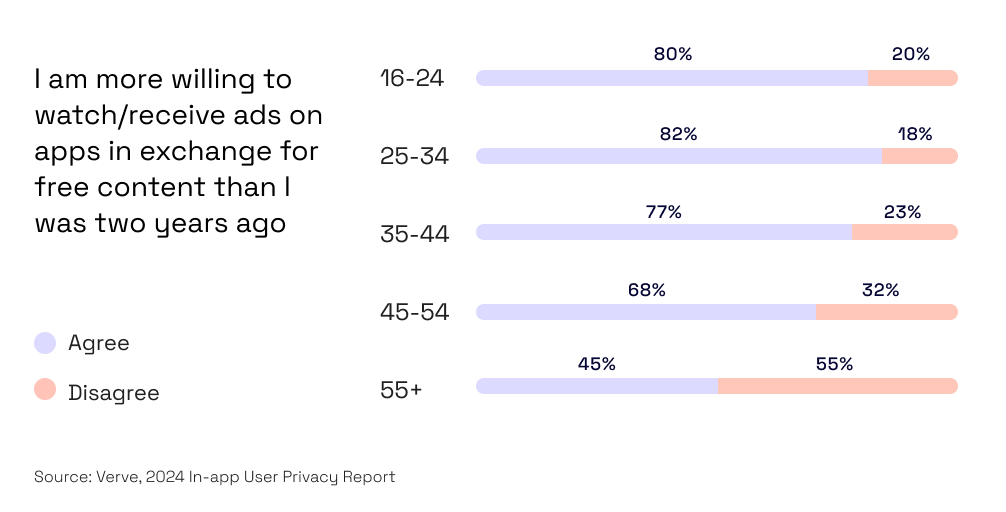

Looking at respondents’ age data, it is clear that younger generations have a better understanding and acceptance of the in-app advertising value exchange. Over 80% of those under 34 years are more willing to watch ads in exchange for free content than two years ago. However, this willingness sees a dropoff with older generations.

Takeaway for advertisers

Millennials will soon wield the most purchasing power of any generation — and Gen Z’s collective spending, especially in the digital realm, is growing rapidly. The high willingness of these age groups to watch ads makes in-app advertising an effective way to reach the younger generations.Takeaway for publishers

To ensure a pleasant UX for users that may be more resistant to in-app ads, activate solutions that can assess anonymized on-device activity and group audiences into interest-based cohorts. This will allow for precise targeting, without personal data, that delivers contextually-relevant ads.Where are users most likely to share their data?

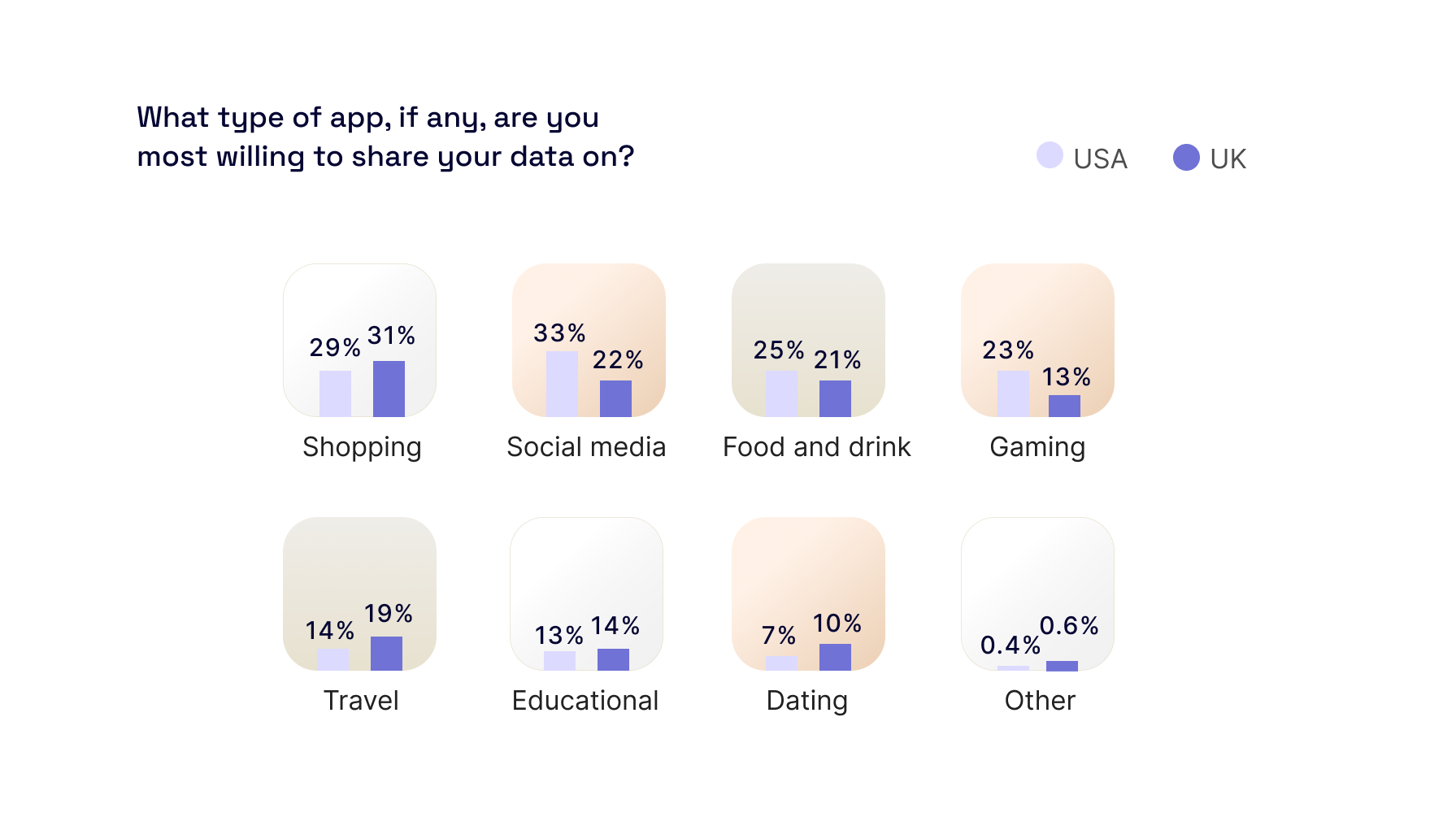

All apps are not created equal when it comes to users’ data preferences. Shopping and social media top the list of share-worthy apps. This isn’t surprising, since the respondents to our survey also indicated an appreciation for contextually-relevant advertising and likely welcome a product or service recommendation within these types of apps. The increasingly popular category of gaming also ranked quite highly, likely due to its association with in-app perks such as an extra game life.

Takeaway for advertisers

To reach users where they are most receptive to receiving ads, you can set specific targeting parameters or even purchase inventory via pre-packaged deals to ensure that your ads are being shown within apps of a specific category.Takeaway for publishers

Deploy robust testing to achieve the best ad fit. This includes running A/B tests to see which ad spaces and formats yield the most desired actions for your app and provide the best experience for your users.Further insights

This is just a sneak peek of the data available in our In-app User Privacy Report. Download the report today for further insights into consumers’ attitudes towards data and privacy, including:

- Which data users are most willing to share with mobile apps

- How to create valuable ad experiences for app users

- Action items for publishers to build trust and increase first-party data