User acquisition

- Case Studies

LinkedIn cuts CPI by 38% and scales app activations with SKAN optimization strategy

- Blog

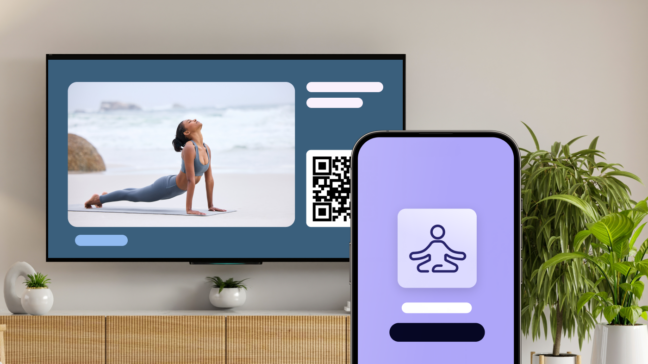

How to turn CTV into a UA channel

- Blog

Performance CTV: Using CTV’s halo effect for cross-channel UA

- Blog

Contextual, redefined: Why AI makes it a performance play, not a privacy fallback

- Blog

How Rovio rewrote its UA playbook in the post-IDFA era

- Blog

The case for mobile gaming apps and video advertising

- Blog

Back to Basics: Open box of opportunities with open-source SDK

- Blog

Introducing HyBid SDK 3.0: Your fast lane to performance in a privacy-first world

- Blog